WBD Spin-Off: My Quick Take on the Announcement

Annotations on the investor deck as Warner Bros. Discovery splits into two

Today WBD held a business update call where they formally announced the long-anticipated separation into two entities. The call was a 8:30 AM this morning, so I want to give subscribers a quick-reaction post based on my initial thoughts. The separation isn’t expected to be completed until mid-2026, so there will be plenty of time to analyze this further. So for now – please follow my thoughts as I show you my annotations to the investor deck.

You can find the PDF of the presentation on the WBD website here.

This first page feels like the scoreboard at the start of a championship match, where they list the starting lineup for each side for those fans who didn’t tune in during the regular season.

This is the split that investors had been expecting, so no surprises.

1) Global Networks - basically all the linear cable channels, except HBO

2) Streaming & Studios which has the TV and movie production assets, the entire streaming apparatus, and HBO.

Value investors know that any company can be a good investment at a certain price. Later next year when WBD creates tracking stocks for the two companies, we will have a better sense of the relative valuation.

I find this page listing “key successful milestones” to be a bit amusing to read. Because the very fact that WBD is doing the spin-off in the first place is an admission the last 3 years have not been successful. At the end of the day, everyone can see that this marriage did not work.

Let's analyze each of the 5 pillars of the investment case and I'll tell you what I think:

“Enhances strategic focus to better position each company to maximize its potential”

This is Corporate speak for, “Our current strategy wasn't working so it was time to tear the whole thing down.”

“Aligns investment priorities with each company’s respective strategic and financial objectives”

Separating the businesses will allow each of them to cater to the wishes of their respective investor base (see #5).

Post-spin, Networks as well as Streaming & Studios will have different cost structures, revenue trajectories and capital structures.

“Facilitates separate management teams to focus on objectives of each business, with incentive structures aligned with the long-term success of each company”

With the businesses separated, executive compensation can be more directly linked to company-specific KPI targets.

While I agree that creating clear incentives for management is always good, WBD did not fail because Zaslav didn’t get enough stock options.

“Provides each business with greater agility to capitalize on potential value-creating strategic options”

This bullet is saying the two businesses have more optionality if they are apart. Separated from the Studios, the network's business gains flexibility to source content from non-WBD related production partners. The networks could join other competitor bundles with partners that didn’t fit with the HBO brand. Separated from the networks, the studio could have more flexibility to create content for other video services.

In short, one could dub this bullet the “Every man for himself” strategy.

“Allows WBD Global Networks and WBD Streaming & Studios to better target appropriate investors based on their distinct financial profiles”

Investors will be able to “choose their own adventure”.

CEO David Zaslav, will lead Streaming & Studios and the current CFO will lead the Networks business. This makes sense having your celebrity CEO lead the creative half of the enterprise, while the “numbers guy” makes sure that credit investors are happy.

There is no rush to invest today - the deal will likely close mid-2026, so we will have plenty of time to analyze this further.

However, a lot can change in only a year! I said many times on this Substack that YouTube's viewing share will only continue to grow.

The spin-off will be done in the tax-free manner, not a surprise to anyone who's been following John Malone companies.

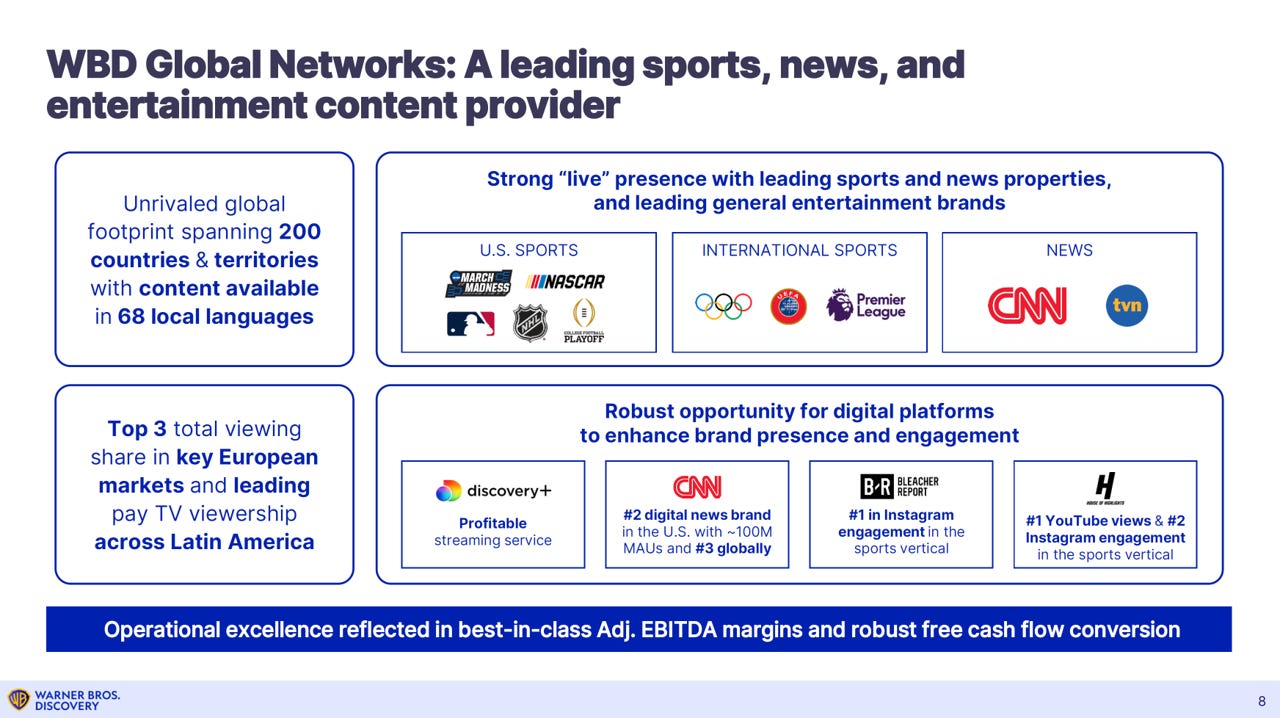

This is the first of three pages explaining the asset split between the two companies. Any good media investor relations deck has to have at least one page with high-resolution brand LOGOS.

Global Networks brags about their “high margins” and “cash flow conversion” because they are speaking to an audience of credit investors.

The Streaming & Studios section focuses on more intangibles, such as “momentum” - because it is harder to forecast revenue for hit-driven businesses.

It's notable that they only mention Sports and News, and not reality programming, as the keys to the Networks.

Pre-merger, Discovery was applauded by investors for having strong reality television programming, because it was cost-efficient and was able to translate well into different languages and geographies. In theory, it was supposed to balance the more expensive programming on the HBO side. Now, reality TV doesn't even get a mention.

They make a weak case for being a “strong player” in sports. MLB baseball and NHL hockey are not strong enough sports content to be a major player in the U.S.

WBD has international rights for Olympic games, but you can’t build a business around a 4 year programming event.

While Zaslav would never admit it - deep down I bet they wish they still had that NBA package to anchor their sports schedule.

The Streaming & Studios page just paints a much more optimistic picture for investors. The theme is growth growth growth! They claim to have significant subscriber growth, and a lot of addressable markets they have yet to fully reach.

While it is true that WBD Streaming has yet to reach much of Europe (UK, Ireland, Germany and Italy) a part of me wonders if this is a moot point and WBD is already a bit too late to expand globally.

I am not fully convinced that HBO is as strong a brand as many think. While HBO has iconic hits, the past few years have shown that HBO was perhaps more of a beneficiary of the protection of the cable bundle then maybe we had realized all along.

While I agree they have amazing intellectual property, I am not sure how much that matters anymore. YouTube has demonstrated to the world the power of user-generated content, therefore diminishing the competitive advantage of “Legacy” brands.

Having been a media investor for almost 20 years, I don't believe “Legacy” matters as much as good storytelling and fun experiences.

The new Harry Potter television series for HBO will be the most important IP asset for the Streaming & Studios business. It could drive subscriber growth and reduce churn for the next DECADE, if they do it well.

Ultimately, I think Potter, more so than Superman, will be key to the upside case.

The purpose of this page is to remind WBD’s many debt holders that they have a clear plan to pay all their maturities.

I think “de-leveraging” and “healthy free cash flow” all sound good in theory, but WBD’s future path to debt paydown is all based on projections. If revenue surprises to the downside, given the high fixed cost structure of BOTH businesses, EBITDA and FCF could evaporate quite quickly.

The Network business will not be something that you can put in your portfolio and forget about while you collect dividends. Cord cutting is still happening and could easily accelerate in the coming years.

Presentation ends by reiterating the 5 main strategic benefits behind the spinoff that WBD gave earlier on page 5.

Overall, I’m sticking with my feeling that WBD stock will underperform the market, at least until the separation is complete.

Cord cutting and audience attrition pose significant risks to the Networks business. Investors interested in Streaming & Studios may avoid WBD due to the Networks component.

Bottom Line: There's currently no strong reason to buy WBD stock today. Opportunities for long positions may arise closer to the spin-off, once we see the relative valuation between the businesses.

-Accrued Interest

you understand its at 5.5 p/fcf vs 60 p/fcf for netflix, you are talking of 11x difference

and thats after interest payments on debt as its fcf.

2. nflx was 80bn$ mkt cap in q4 2017 dtc ebitda 700mn$

who has 670mn$ dtc ebitda in q4 2024? Wbd. Who will double it wbd to 1.3bn$ ebitda 2025 q4

3. same as netflix doubled dtc ebitda q4 2018 to 1.4bn$ and mkt cap rose to 180bn$

you understand its at 24bn$ for all companies + studios not only dtc ebitda 10-15% of total ebitda...