Media Stock Insights from Nielsen’s May-25 TV Snapshot

What does it mean now that streaming finally surpassed linear TV

It’s the middle of the month, so that means Nielsen is out with its May 2025 Guage report, exploring what Americans are watching on their big screen televisions (excluding mobile). Yet again, YouTube ($GOOGL) and its user generated content is taking share from legacy media. I don’t care if it’s boring to tell the same story each month, but media investors need to acknowledge the unavoidable truth of what is going on. I’ve been reporting on YouTube’s rise in April, March, Feb, and Jan of this year. Here are the key takeaways from the May report…

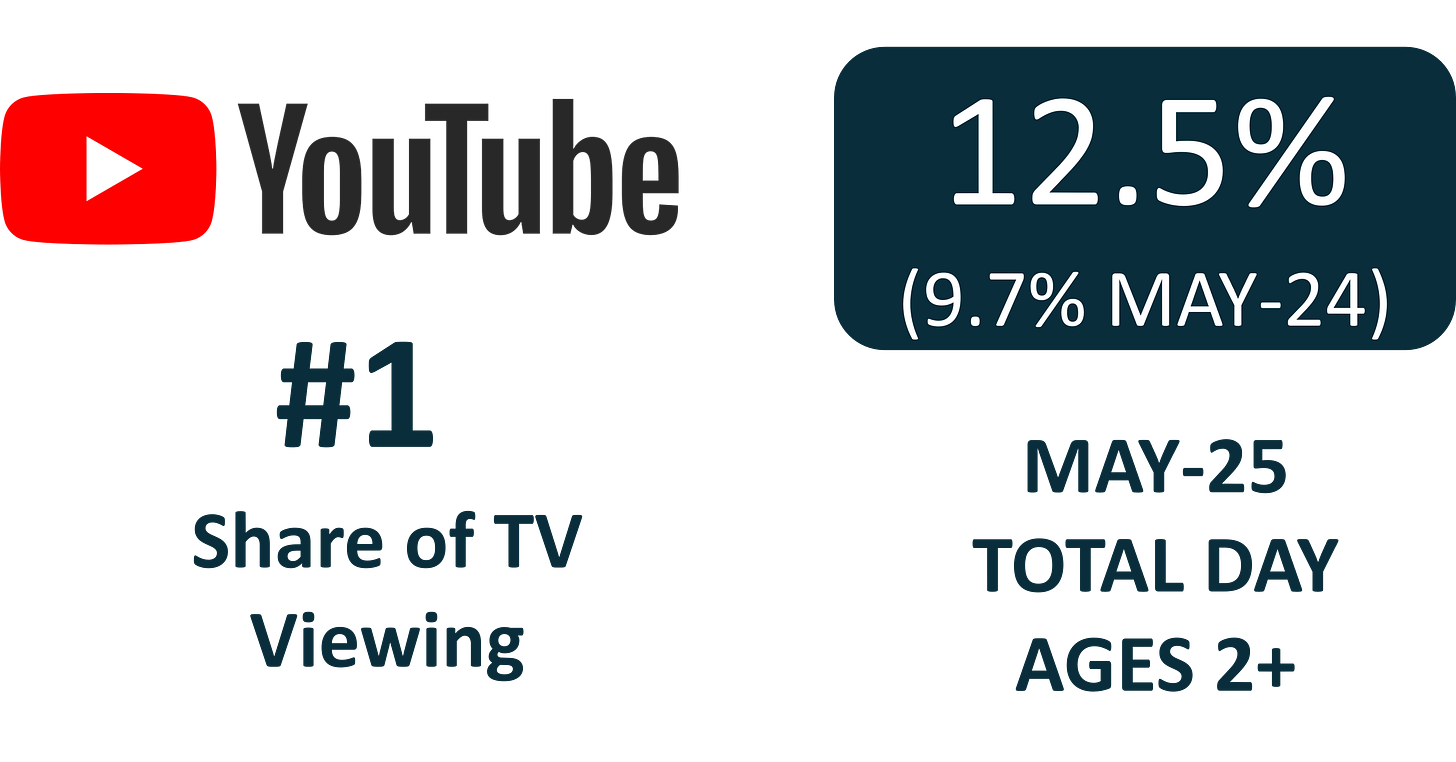

1) YouTube continued at #1, with a new all-time high TV viewing share

YouTube gained +2.8% share points vs. May 2024, more than any other service. Again, this is the main YouTube site with user generated content and not YouTube TV which is basically an online packaging of linear cable channels.

The 12.5% share is not only the highest share of TV for any streamer to date, but the fourth consecutive month of share gains in 2025.

Investors who overlook YouTube are prone to make major errors in their forecasts.

YouTube's gradual dominance is impressive, especially as it gains share without high-profile sports. YT became the exclusive home of the NFL Sunday Ticket package in 2023, but their string of record-breaking months in 2025 have come without the help of NFL regular season games. I can only image what YT’s share will look like once football comes back in the fall.

Some writers want to make investing seem more complicated than it truly is. The substantial influence of YouTube has been a significant factor contributing to my optimistic outlook on Google stock. Check out my Q1 review of Google’s earnings in my archives here.

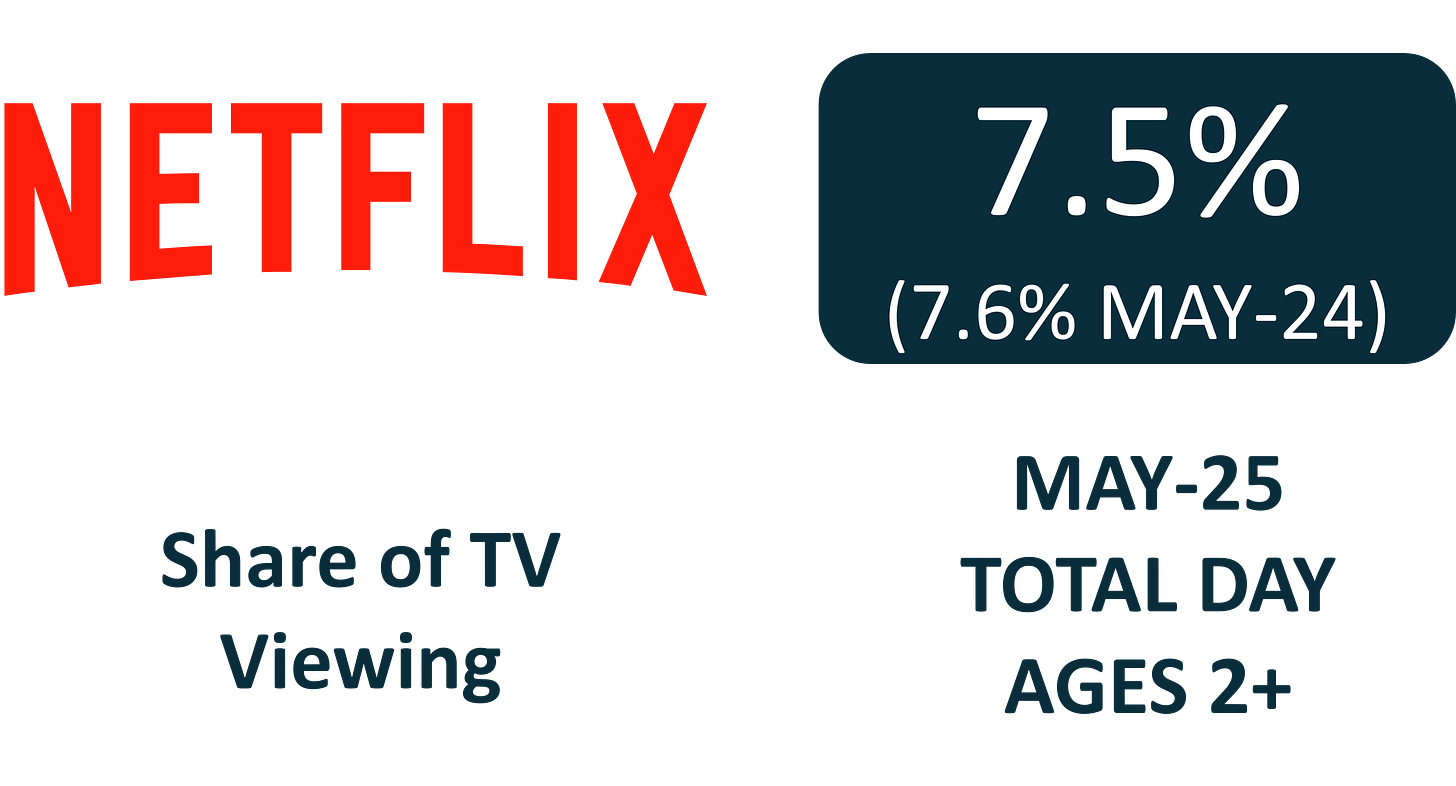

2) Netflix is still #2, but share gains have plateaued

Adding to my concerns that NFLX has plateaued, its share was down -0.1% pts vs. May 2024. Netflix’s share last peaked in Feb-2025 at 8.6%. Overall, YouTube appears to be stealing growth from various streaming services. The only other service that gained at least 1% pt was Roku. Roku went from 1.4% in May-24 to 2.4% in May-25.

Amazon had the second biggest YOY gain, but that was still a modest +0.5% share pts, going from 3.0% in 2024 to 3.5% last month. Amazon is making a lot of aggressive moves to open themselves up to receive more television ad dollars. (If this topic interests you please subscribe as I will be covering it more in follow-up posts about the Upfront selling season!)

I’m still bullish on Netflix as a company, as well as the stock, $NFLX. Looking at the big picture, NFLX has separated itself from all other streaming services. For May, NFLX’s 7.5% was 50% greater than Disney at 5.0%. Keep in mind, the only reason Disney charts this high is because Nielsen includes Disney+, ESPN+ and Hulu SVOD.

Netflix remains in the #2 spot because it serves as a staple streaming service for general entertainment, with most interested Americans already subscribed. It is apparent that the average viewer perceives other streaming services as complementary to Netflix. They maintain their Netflix subscription regardless of fluctuations in their viewing time, subscribing to additional streaming services on an as-needed basis.

In my latest piece on Starz, I highlighted that management explicitly said they want to be seen a “complementary” or “add-on” service for streaming viewers to combine with Netflix, Hulu or HBO Max. Here’s a snapshot from the Starz May 2025 investor presentation here.

Although I am unsure of Starz's future success, I commend their transparency in choosing not to compete directly with Netflix.

3) Streaming achieved its largest share to date with 44.8% of TV in May

Streaming share outpaced the combined share of broadcast and cable for the first time ever! Streaming was at 44.8% share vs. 44.2% for linear (Broadcast 20.1% and Cable 24.1%). See the streaming share circled in the dotted line below.

Broadcast share was down -2.2% pts YOY and Cable was down -4.1% pts. Note – this is why local TV stocks such as Nexstar (NXST) try to put a positive spin on the share loss by quoting broadcast’s share of LINEAR TV. In my Nexstar piece from last week, I called out their claim that “broadcast has gained share of linear TV viewership”. Here’s a snapshot of the slide from their investor deck below.

I pointed out that saying broadcast has gained share vs “of all LINEAR” simply means that it has declined more SLOWLY than cable. Personally, I am not interested in investing in an ice cube that melts more slowly than the other blocks of ice. I’m looking for GROWTH.

Overall, FAST services continue to grow as PlutoTV, the Roku Channel and Tubi (FOX) combined for 5.7% of TV Viewing in May. You will notice the services experiencing the highest growth are NOT from major legacy media providers (WBD, DIS, PARA).

The key to media investing is separating your forecasting from your personal television tastes.

Despite all the glossy media plans and investor decks, audiences are voting with their remotes each month and increasingly choosing to watch user generated content and free, ad supported content from digital-first platforms without ties to the legacy cable bundle. While Warner Bros. Discovery (WBD) and others are focused on financial engineering, here at Accrued Interest we will let the fundamentals drive our investing process.

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.