Decoding the STARZ Investor Deck (STRZ)

Reading Between the Lines of the May 2025 Investor Presentation

Last week I began coverage on Starz Entertainment ($STRZ), following its separation from Lionsgate ($LION) as a spinoff. Today I wanted to share my annotated notes on the latest investor presentation so we can discuss their strategy. As I said in my bio, before Accrued Interest, I spent years building board presentations, investor decks and executive briefing packages for broadcast, cable and radio companies. Let me show you how to read these documents like an insider.

If you want to follow along with me, you can find the PDF of the presentation on the STRZ website here. Now, let’s dive in!

Before we get to the first page - I want to explain the thought process behind how investor decks get made. Starz/Lionsgate have been public now for several years and are well known to investors and TMT specialists. However, with the spinoff — BOTH companies have an obligation to do outreach to new, perspective investors.

Remember, as mentioned in my deep dive yesterday on the Warner Bros. Discovery (WBD) spinoff, the separation will allow each company “to better target appropriate investors based on their distinct financial profiles”. Said another way, once the two stocks go their separate ways, each side will NEED to replace a sizeable portion of their shareholder base.

Let’s examine this page-by-page and I will give you my thoughts on what the strongest and weakest parts of the investment case are as presented by management.

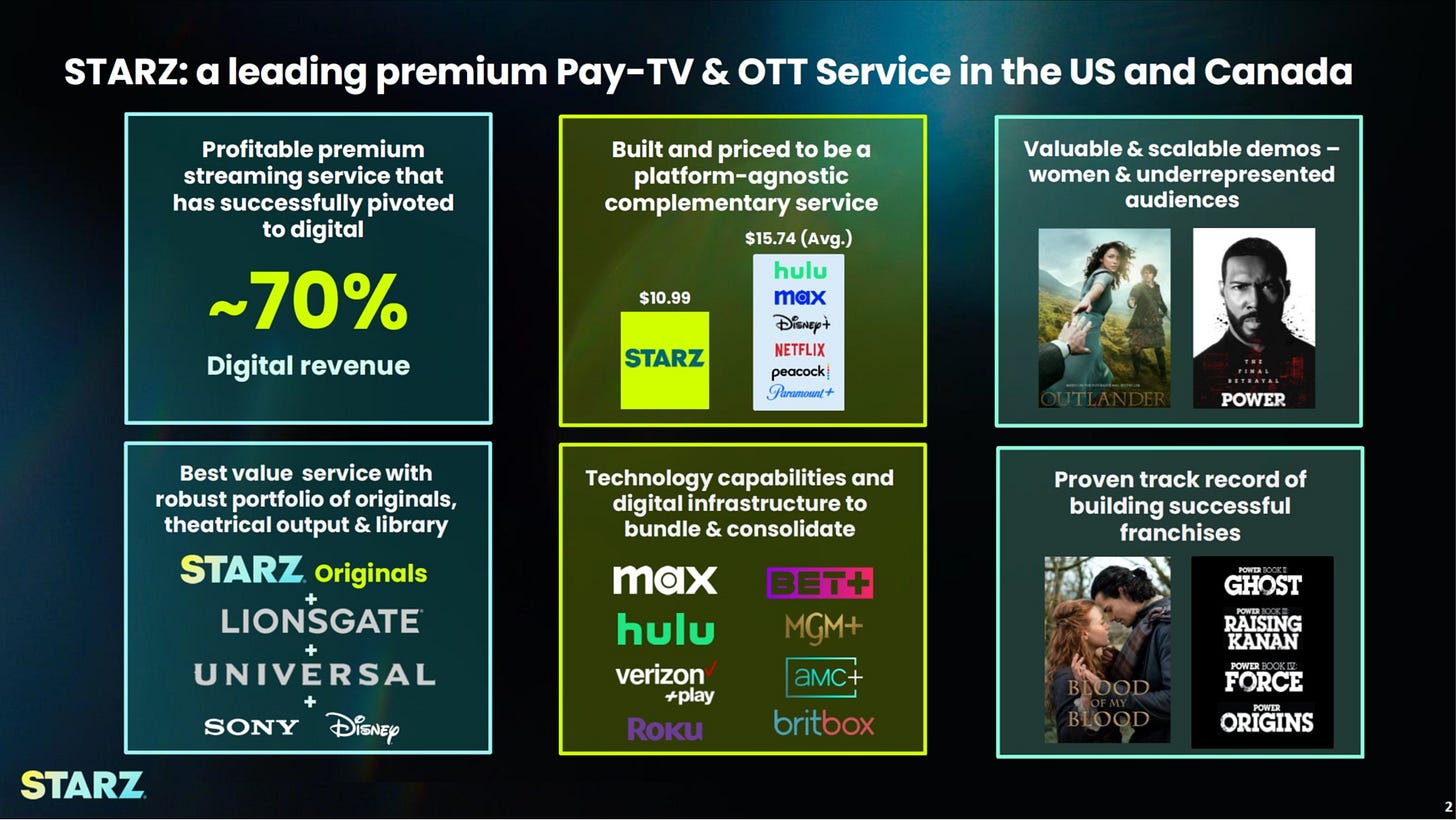

“Starz: A leading premium Pay-TV & OTT service in the U.S. and Canada”

Saying you are a leading “premium Pay-TV” service in 2025 is not much of an accomplishment. This genre of network was very profitable during the boom years of the cable bundle (2000-2010’s), with HBO as the clear leader, followed by Showtime with Starz a distant third. Fast forward 20 years, and now only HBO is top of mind to consumers, and even they have had difficulties adapting to the streaming age.

“Streaming service that has successfully pivoted to digital - 70%”

STRZ is trying to tell investors that they have already “made it” in streaming with 70% of their revenue already digital. While that 70% is factually true - it is not NECESSARILY a sign of strength. If you take anything from today’s post, realize that digital is not always better.

Digital revenue is DIFFERENT. Whether or not that is good or bad, depends on the situation. Typically, when dealing with TV channels, digital subscribers are lower margin, more likely to churn and have a higher all-in customer acquisition cost. We will examine whether being “70 digital” is ideal, later in this piece.

“Best value service with robust portfolio of originals, theatrical output and library”

This is not a compelling argument to me for the STRZ long case, because this reminds investors the power of the Lionsgate (LION) library titles.

“Built and priced to be platform-agnostic complementary service”

I think THIS RIGHT HERE is the most likely bull case, should Starz surprise to the upside. By positioning themselves as an “add-on” channel to your base service of Netflix or Hulu, Starz can “re-bundle” themselves and recreate some of the lost benefits of the old cable ecosystem.

“Technology capabilities and digital infrastructure to bundle & consolidate”

Irrelvant from an investor standpoint….I’m not buying STRZ for the tech.

“Valuable and scalable demos - women and underrepresented audiences”

While this is a common sentiment you hear all the time - I disagree that women and Black audiences have any special loyalty to Starz. The audiences demonstrated strong loyalty to the shows, not the channel, and it is essential to retain their allegiance through engaging and high-quality storytelling.

“Proven track record of building successful franchises”

Starz is hoping that investors do not realize that their top two franchises, the Power connected universe and Outlander both began in 2014, and are running out of steam.

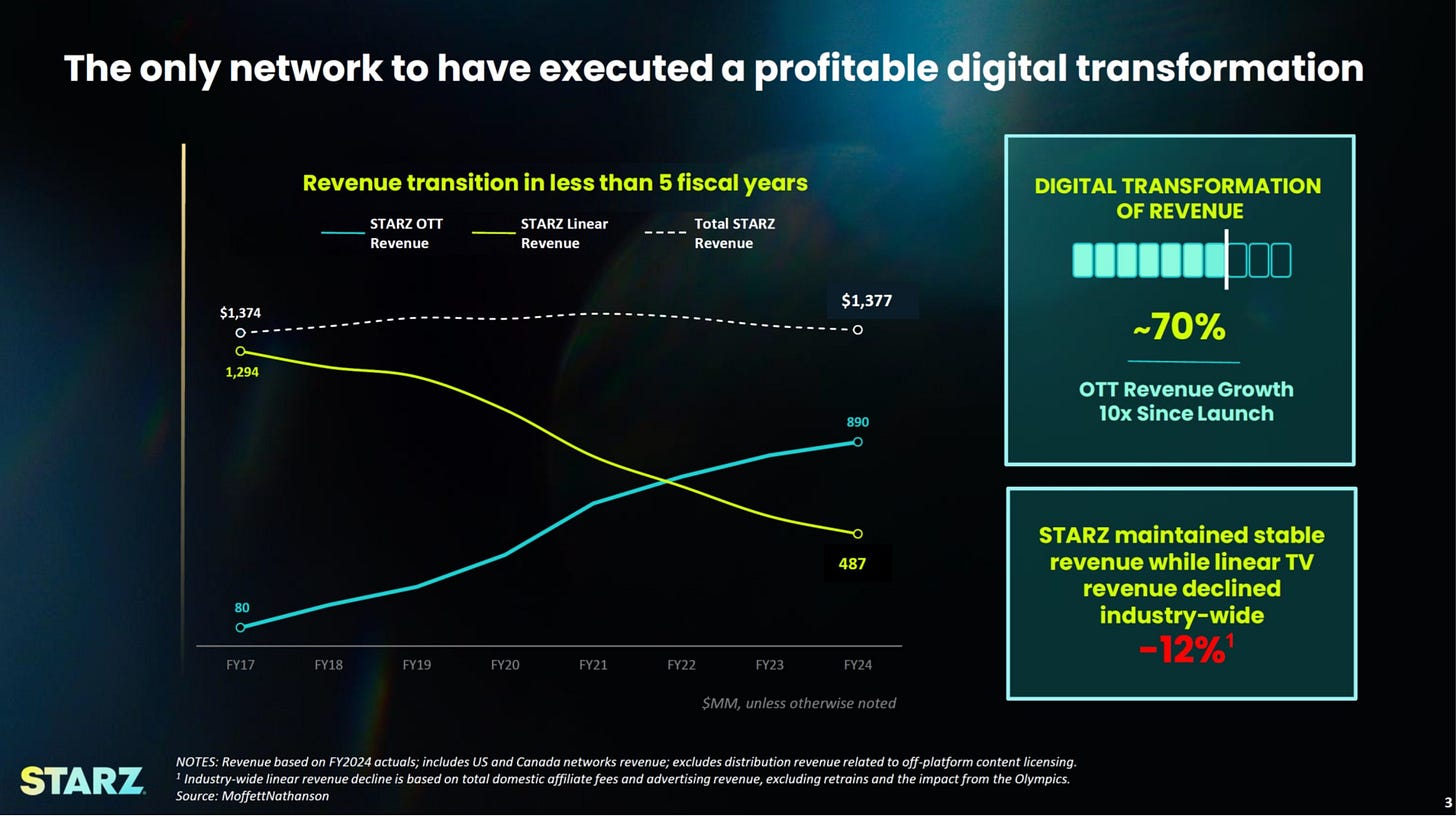

On slide 3, Starz is taking a chart of their revenue mix and trying to argue that it is a competitive advantage. This is a bit of a stretch. A major reason for the 70% Digital revenue is due to the significant decline in linear revenue. As the cable bundle has been unraveling at a faster pace over the last decade, Starz was often the first “premium” Pay-TV channel dropped when customers wanted to cut back on their bills. Starz's rise as a network was largely due to being bundled with HBO and Showtime. Please see my prior piece on Starz where I found an old-writeup from 2015.

I said back in 2015 “Starz has exhausted its ability to add profitable new subscribers. With HBO Now, and soon Showtime, going direct to consumer, Starz won’t as easily be able to ride their coattails.”

While maintaining “stable revenue” is admirable, as an equity investor we NEED to see a path to organic revenue growth, or else STRZ will be another value trap.

Slide 4 shows the reader that two of their more recent shows, Power - Ghost and BMF, rank amongst the highest “hours viewed per subscriber” in all of streaming. Starz claims this shows their subscribers are highly motivated to watch, leading to lower churn and increased retention.

When I used to build charts like this at my job in television, the key was to be truthful while presenting the data in a way most favorable to your network. I want to draw your eyes to the footnotes in the tiny font at the bottom of the page…

In the footnote, it says “Starz data from internal sources”, but competitor data is from Nielsen. It also says, “Competitor data likely higher than Nielsen results".

Starz is using different datasets for comparison.

STRZ is using internal data which shows a higher “total hours viewed” for their own series, but the lower Nielsen data for their competitors. That’s why STRZ had to concede in the footnotes - their competitors’ shows would “likely” chart higher if they had access to their private data.

Look - I’m not implying this presentation is “fraudulent” in any way. All media companies play games in the footnotes – investors must read them carefully.

“Starz is better-positioned than linear cable networks” is a title that is written in a way to reframe Starz’s competitor set. They compare themselves to declining linear channels to seem innovative.

Why is Starz comparing itself to "linear" networks when it claims to be 70% digital? Starz should compare themselves to other digital streaming services. After all, if 70% of the revenue base is already outside the bundle, investors SHOULD be comparing Starz to Netflix, HBO Max and others.

Again, everything on this page is factually true - I just want to point out the framing.

For my investing style, I am trying to achieve absolute returns, not relative outperformance to some benchmark or group. It is not enough to just be “better positioned” than linear networks, like $WBD or $PARA. If you re-did this page and compared Starz to the digital-first competitors, the story would not be as compelling.

Lastly - over the years I have become skeptical as an investor when a management team is complaining about their “low valuation”. On the last line, STRZ claims that their EV/Adj. OIBDA multiple of ~3.5x is too low, compared to the 4.5x - 6.0x range for traditional cable networks. I don’t find this argument to be self-evident. Life experience has taught me that most low multiple stocks happen to be cheap for a reason. You may disagree with said reason, but Mr. Market is telling us that investors consider Starz’s current business model to be LESS desirable than your average linear cable network.

Life experience has also taught me that “cheap” is not a catalyst. The only way the STRZ valuation gap will close is by proving to the market it can generate organic growth. Cutting back on content costs alone will not lead to multiple expansion.

CONCLUSION

Overall, I think this STRZ investor deck gives an OK overview of the assets to those new to the story. However, I think management is doing too much “telling” and will need to “show” they can organically grow their subscriber base greater than the paltry 1% - 3% they have recently been guiding.

For the bull case to work, I believe STRZ’s two best paths to growth are 1) as an “add-on” partner of choice for bigger streaming services, and 2) developing new hits outside of the Power and Outlander franchises. This entire deck was too backwards looking. We will need to see the 2026 - 2027 programming slate to better evaluate whether Starz can flourish away from Lionsgate.

I regret missing STRZ stock when it was trading under $12. Kudos to you if you got it post-spin. But at $17 - $18 a share, and above, Starz will have to do more to prove the growth prospects, otherwise it is reasonably priced for the risk.

Let’s watch STRZ to see if it sells-off back to the low-teens. But at $18, $19 and $20+ I rate STRZ as underperform, until we get more data on the 2026 shows.

-Accrued Interest

One fundamental problem with the traditional media / broadcasting industry is very high competition. There are no barriers to entry. Paramount, Disney, Comcast, etc. are all building their own streaming platform and supply simply is vastly bigger than demand. Tough times ahead...