In this post I am going to give my reaction to the Charter Communications and Cox Communications merger, announced Friday May 16th.

I consider Accrued Interest the public demonstration of my private research process. When M&A or other deals get announced, I take annotated notes along side the company’s investor presentation. Let’s dive right and see what this deal can teach us about the state of media investing.

Value Creation for Customers and Shareholders

In the 2nd bullet on this slide, Charter cited the “significant opportunity to deliver Spectrum Mobile benefits to customers in Cox footprint”. These would be additional customers that would have been challenging to reach without the merger.

Charter announced “$500M of cost synergies within 3 years”. Sometimes management low-balls synergy targets during strategic mergers, to not overly scare the employee base. (Note - I have not seen academic research on this, I am just sharing my opinion from experience.)

Whenever you combine near identical businesses, potential synergies are huge, in theory. Given the overlap in operations, one could theoretically remove all the back-office functions for the target and slot it into the parent. I am not suggesting Charter will completely gut Cox SG&A. On the contrary, given the relative lack of footprint overlap, Charter may need SG&A in those Cox markets for years to come.

“3.5 - 4.0x target leverage within 2-3 years after close of transaction”

This is a reminder that when investing in cable companies, you are dealing with businesses that operate with inherently high leverage.

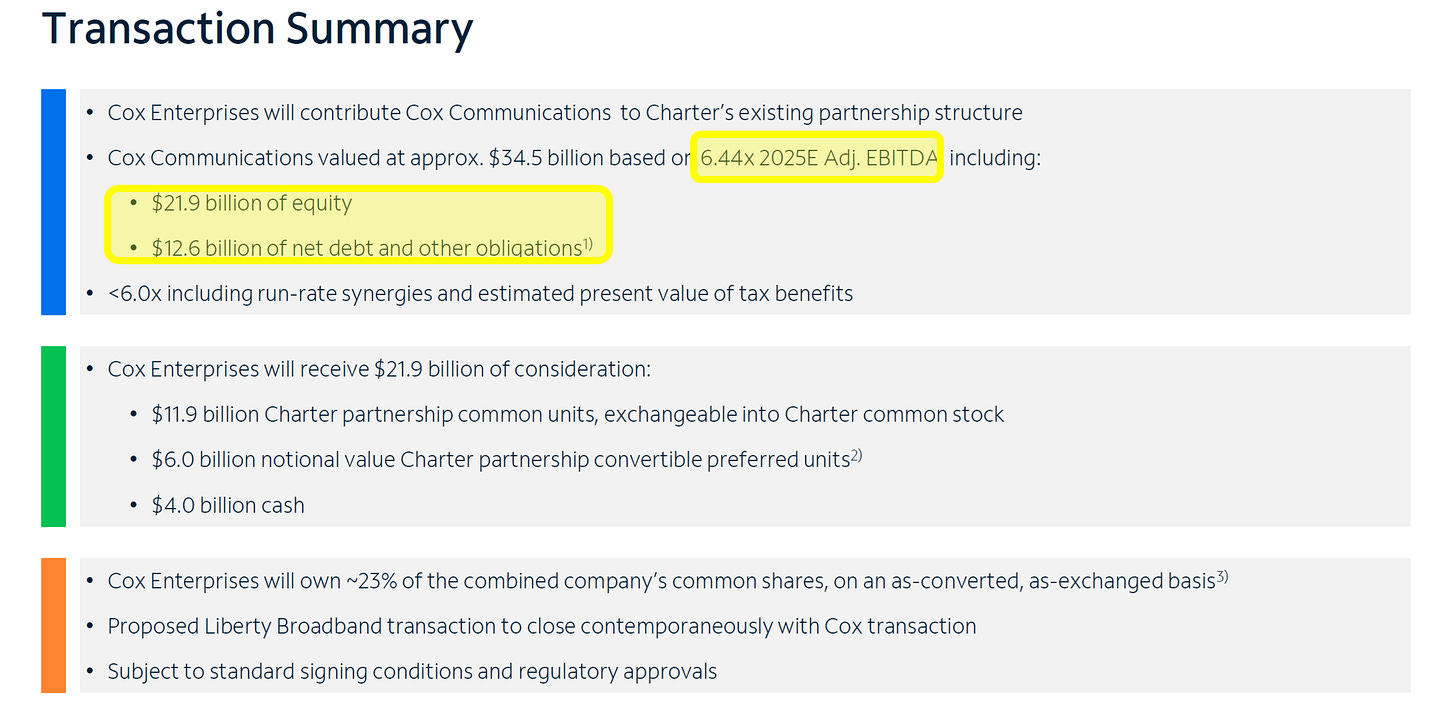

“Cox Communications valued at approx. $34.5 billion based on 6.44x 2025E Adj. EBITDA”

I wonder if the Cox family regrets not selling out sooner. I have been following the TMT space for almost two decades now, and seeing Cox go out at 6.5x EBITDA is ridiculously cheap when I know they could have earned a higher multiple in the past.

Over the weekend I learned in Barron’s that Craig Moffett, analyst with MoffettNathanson, called the multiple “an absurdly low price”, so perhaps I was not too far off.

“$21.9 billion of equity, $12.6 billion of net debt and other obligations ($11.9 billion of net debt and $0.7 billion of finance leases)”

The Cox family is rolling equity into NewCo, hanging along for the ride. That works out to 54% Charter equity, 27% Charter convertible preferred and 18% cash. Cox will own ~23% of the combined company’s common shares, on an as-converted, as-exchanged basis.

This is a footprint map that shows the combined coverage, and the lack of regional overlap stands out.

“The combined company will change its name to Cox Communications within one year of close”

I found this interesting because usually NewCo does not assume the name of the target, especially one with ~18% of the combined customer base. Probably indicates Cox name brand is better received than Charter.

Under “History of Innovation” – the deck states “The Cox family is the longest continuous operator in the cable industry, having bought its first cable franchise in 1962”. Perhaps the family’s long involvement prevented them from exiting when valuations were higher years ago.

New Company: At a Glance

This “New Company” chart lays out the mix between Charter and Cox in terms of customers, revenue, EBITDA and Capex. I calculated what percentage (%) of each KPI comes from Charter and Cox, respectively. See my numbers below here:

Charter will have 82% - 83% of the customer relationships and cable passings. They also over-index on video with 88% of video subs, which is even higher than their customer mix.

Management views it as an OPPORTUNITY that Cox today only has 2% of the mobile lines. A strategic key to the merger will be Charter trying to sell the Spectrum Mobile offering to Cox customers.

Transaction Financing

My eyes immediately went to the pro-forma leverage. NewCo will have 3.93x Net Debt / EBITDA, which is still high for a company with secular growth concerns. (Yellow highlight added by me)

Chater “anticipates reducing target leverage to the middle of the 3.5x-4.0x range, over 2-3 years post-closing”. This says to investors “don’t expect us to pay down debt too quickly”.

Investor Conference Call Takeaways – Below are few themes that stood out to me from the Q&A section (any emphasis added is mine).

Acknowledgment of Low Industry Valuations

Christopher Winfrey (CHTR President and CEO):

“While this transaction has taken place in a period near historic low industry valuations, with the exception of upfront cash, Cox is exchanging for equity in the new company. They aren't to sell it. And at the closing of the Cox transaction, we'll accelerate the closing of the Liberty Broadband merger. And in many respects, Cox family as long-time cable investors will effectively take Liberty's place as long-term capital, which provides strategic value, including on our Board.”

As I mentioned up top, an acquisition multiple of 6.4x EBITDA would normally be considered “cheap”, or at the very least, not expensive. That is a multiple one would expect to pay for a private, middle-market company. Usually, high-quality companies with enterprise values in the billions trade for higher multiples.

Regulatory Concerns

On the call, the CEO said he did not anticipate much regulatory risk because there is not much overlapping footprint. Here is the footprint map included in the M&A presentation once again so you do not have to scroll up.

High-speed internet services providers, such as cable companies, have historically been local oligopolies. That means in most American cities, there’s typically just one or two broadband providers with all the market share.

Regulators want to avoid mergers that could end up creating (or entrenching) local monopolies. By pointing out that Charter and Cox operate in mostly different markets, management wants to assure investors this deal will be approved.

I do not profess to be an expert in antitrust rules, but I find their argument plausible.

Impact to the TV / Video Streaming Industry

When the topic of video came up, the CEO named YouTube a top competitor, along with the many SVOD apps. As I’ve said in multiple posts on my substack, investors underestimate the rate at which YouTube continues to steal TV watch time from other competitors. (See - 3 Things We Learned About Media Stocks from Nielsen’s TV Snapshot - 4/22/25)

To be fair, Charter’s Spectrum TV app, if it were treated as a virtual MVPD, would be the largest in the country. That means the new company will be the largest provider of streaming pay-TV in the U.S. To get a better comparison in scale to the other to pay-TV providers, I’m sharing a table of the largest MVPD’s taken from the Fubo TV investor relations deck. (Yellow highlights for Charter / Cox added by me)

The Fubo deck was from January. Charter had 13.0 million video subs and Cox had 1.9 million. It appears both services lost subs in Q1. According to Charter’s merger presentation, they say Charter ended Q1 with 12.7 million video subs, down 300K. And now Cox has 1.7 million video subs, -11% less than Q4’s 1.9 million. That is a combined loss of a half million subscribers (or -3%) in just 3 months.

Final Thoughts

If the M&A announcement did not already convince you cable companies had given up on the TV business – check this CNBC’s interview with senior media analyst Craig Moffett. Craig Moffett on Charter-Cox merger: They are poised to win in convergence

Moffett said that Cox had been a rumored takeover target for “almost a decade now”. But the Cox family were always unwilling sellers…until now.

“This deal is mostly about wireless” Moffett said. He pointed out that even in the press release, Charter described themselves as “providers of mobile and broadband service” putting mobile first.

Charter has an MVNO, a reseller relationship, with Verizon. An MVNO, or Mobile Virtual Network Operator, is a company that provides mobile services but does not own its own wireless network infrastructure. Instead, they lease network capacity from Mobile Network Operators (MNOs) and resell it under their own brand.

The way the cable industry is evolving - the broadband business will be core for companies like Charter, followed by growing the mobility (wireless) service. As Moffett said, the video business is “not that much more than an afterthought”.

I want all media inventors to take in that last comment.

When you hear about “cord-cutting”, I urge you to differentiate between “video” vs. “broadband”. This Charter/Cox deal is evidence cable companies will keep losing video subs at a high rate, because they are not even trying to defend the video product.

Anything that accelerates (or at the very least fails to stop) video cord cutting is undeniably bad for TV stocks. The fact Charter/Cox may have lost a half million video subs in 3 months, and nobody bothered to even mention it on the M&A call, is a reminder that video has indeed reached “afterthought” status.

If you are an investor in any of the cable channel stocks (WBD, DIS, PARA, etc.) or broadcast stocks (NXST, SBGI, TGNA, etc.), - you MUST realize that falling pay TV subs lower the future earning potential for everyone tied to the legacy TV industry.

Let us not lose sight of this unfortunate fact, and make sure our earnings forecasts are realistic. Media investors should not expect that direct-to-consumer streaming services will compensate for the lost earnings that are unlikely to be recovered.

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.