Media Investor Takeaways from Disney Q2-FY25 Earnings

Disney gave hints on the future of video entertainment

Disney reported Q2-FY25 earnings today. Similar to my post on Meta vs. the FTC, I often find great datapoints I can use to analyze my other investments inside the presentations of the biggest media companies. See my piece from yesterday where I began formal coverage of FuboTV stock. Disney’s earnings help put Fubo’s in better context.

Recommendation: No rating. I’m just using Disney as a source for datapoints on the media and entertainment industry trends.

Ownership: I have no positions in Disney stock or options at the time of writing.

Here are my biggest media takeaways from Disney:

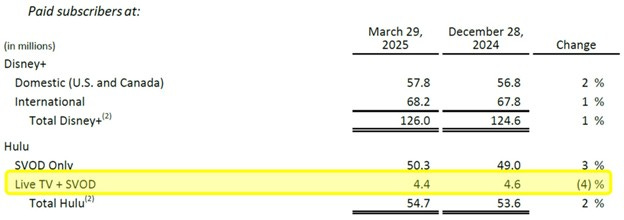

1)HULU + Live TV is the worst performing Disney DTC service

Hulu + Live TV is the only Disney DTC service losing subs, down -4% since last quarter (Dec-2024). Whereas Hulu SVOD subscribers were +3%.

Looking at it this way, it’s very clear why Disney opted to sell the inferior part of Hulu to FuboTV. From the conference call it was very clear that Disney management is longer chasing Disney+ sub growth at all costs. With profitability the main focus, driving streaming subscribers is no longer the optimal strategy. There is nothing wrong in admitting this fact.

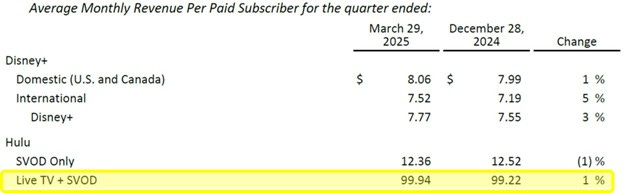

2)HULU + Live TV is an expensive outlier among Disney’s DTC services

Hulu + Live TV stands out as particularly expensive when you compare it to Disney+ and Hulu SVOD. At $100 per sub, someone might as well pay for legacy cable. These high price-point / low margin skinny bundles are structurally bad businesses because they are exposed to all the legacy cable bundle, with few offsetting benefits.

Secondly, the low 1% growth in Disney+ ARPU, even after a year of well-telegraphed price increases, makes me think most new subs are coming from content bundles. (E.g, Disney+ bundled with Max, Hulu, ESPN+, and others)

3)ESPN+ shows sports consumers are price sensitive with DTC

Disney had ~3% subscriber declines at ESPN+ for Q2, despite it’s low ARPU of $6.58. This just shows that even sport fans are price sensitive - will wait to see how they price the new flagship ESPN DTC streaming service.

In summary, Disney earnings remind us that the biggest media conglomerates, outside of Netflix, have abandoned chasing streaming growth because they finally realize they cannot pursue this business profitably. This is something to keep in mind when evaluating FuboTV, and any business selling video entertainment.

Next Catalysts to Watch

We still have a lot more U.S. media companies announcing earnings in the coming days that will give us a fuller sense of the current market.

Sinclair reports earnings today, May 7th, after the bell

Warner Bros. Discovery, Nexstar Media Group and Tegna reports Thursday morning, May 8th

Next week Fox Corporation repots on Monday, May 12th

Stay tuned to this page for more updates during Q1 earning season.

-Accured Interest

Disclaimer: The information presented in this Substack is not and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.