Starz ($STRZ) Is It a Buy at $16.50? My First Take on Valuation

Unpacking Starz’s fair value today

Let’s take the next step in my coverage of Starz ($STRZ) and do some valuation work. I was pleasantly surprised to see - Decoding the STARZ Investor Deck (STRZ), has been my most read article by a factor of almost 300%! Now I’m going to do math in public. My initial take on valuation always leans conservative with all my assumptions. Benjamin Graham summed it up best when he said, "The purpose of the margin of safety is to render the forecast unnecessary." I will do a separate article on the potential upside if things go well, so don’t be mad at me if you don’t see $25+ price targets today! As a baseline, let me tell you why $STRZ is fairly valued today.

BUILDING THE FREE CASH FLOW (FCF) FORECAST

My preferred earnings metric for stock valuation is fully levered free cash flow (FCF). Today I’m getting approx. $100M FCF for Starz, before debt paydown, which I’m excluding for now. I outline my assumptions to encourage constructive disagreement. My aim is to establish a margin of safety, accounting for potential oversights I may not yet recognize.

EBITDA: I started with the current $200M guidance from $STRZ management. They have not provided details, so I cannot diligence how they got to $200M, but I will use it as a baseline and lower assumptions elsewhere.

EBITDA Margin: Current margins are 15%. STRZ management thinks they can get to 20% by 2027 – 2028 by removing extra programming costs from Lionsgate. Let me be frank - I DO NOT 100% buy Starz’s belief that they will get breaks on costs as a SMALLER company which they didn’t get before. Smaller companies typically have less bargaining power than larger media powerhouses. I will not blindly assume margins will EXPAND to 20%, now that Starz is solo. Will revisit.

Interest: $38M interest is 6% of $625M of gross debt. From the 5.29.25 business update, there’s $325M of Term Loan A and $300M of senior unsecured notes.

I am not giving credit for $66M in cash on the balance sheet which lowers the net debt. In theory, interest should only go down as Starz pays down debt. Since growth is challenged, I am using gross debt as of today.

Capital Expenditures: $10M CapEx assumption comes from the $13M I saw in the LGF financials for the LTM period 3.31.25. I attributed most of that to Starz. This Capex could easily be lower. Networks typically have low maintenance capex.

All the above gets us to about $152M in earnings before taxes.

Now, I think most Starz investors are WRONG to ignore taxes. Let me explain why.

Normalized Taxes: $53M assumes Straz is a full taxpayer at a 35% rate (Federal + State). It is easy to forget STRZ has $200M - $300M in NOLs (net loss carryforwards). Today I am going to ignore the NOLs and add back taxes, because with weak growth we do not know how long it will take to use up all the NOLs.

If I were doing a detailed valuation for a Wall St. bank, I would build an NPV valuation for the NOL’s. I do not think this exercise is worth the effort today. Unless growth picks up, Starz won’t be around long enough to generate $200M in pre-tax profits to utilize the full tax shield. Also, while I do not think Starz will be acquired tomorrow, the NOLs would not transfer.

Fully-baked Free Cash Flow (FCF): $100M of FCF (let’s round up from $99.12M), is about 50% of EBITDA. As a sanity check, I think it is normal for an asset-light TV business to convert about half of EBITDA into FCF. So for now, I am OK with $100M as a starting point.

WHAT DOES THE STOCK PRICE TODAY TELL US?

Now let’s bring it together within the context of the Starz capital structure to see the total company valuation.

Using a $16.50 stock price for Starz, with about 16.7M shares outstanding, gets me to a market cap of about $276M.

Now before you say - “Starz is trading at 3x your FCF estimate” - let me tell you to STOP. Debt is real - we can’t just ignore it because it’s high. You must use the TOTAL enterprise value, including debt, to understand the REAL multiple.

Starz is trading at 8.4x Enterprise Value to Free Cash Flow. Imagine you are a private operator who owns 100%, with no debt. The market is valuing the company at 8.4x a normal year’s earnings. Said another way, if you convert that to a “yield” figure, taking 1 divided by 8.4, implies a 12% earnings yield.

I think 8.4x fully-taxed cash flow is a FAIR valuation multiple for Starz because it has serious growth concerns and is struggling to keep revenue flat. When the risk-free government rate is ~5%, I think a 700 bps spread is more than fair.

Simply put, I think Starz stock is fairly valued today at $16.50.

Let’s discuss what it would take to change the market’s perception of Starz.

WHAT $STRZ NEEDS TO DO TO GET MULTIPLE EXPANSION

GROWTH! The market needs to see tangible proof of SUSTAINABLE organic growth, before you should expect multiple expansion and a stock price north of $20 per share. Let me explain why the market is doubting Starz’s ability to grow…

Weak guidance - Management has not provided any specifics around revenue forecasts, just EBITDA. They said they hoped for 1% – 3% revenue growth. Since management tends to skew optimistic, you must discount that to mean Starz would be lucky to have FLAT revenue, of 0%.

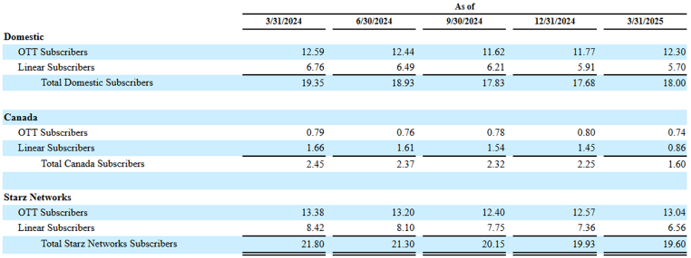

High customer churn - According to recent subscriber trends below, the company is going to have to fight just to tread water. I will get into subscriber trends in future posts, but in summary - U.S. OTT subs were down -2% YoY ending at 12.3M as of 3/31. Linear (traditional cable) subs were down -16% ending at 5.7M subs. In total, U.S. subs were down -7% YoY by the end of Q1. Digital subs need to grow above and beyond the linear declines.

CONCLUSION

As I said in a prior post, I regret not picking up $STRZ when it was closer to $10-$12 post spinoff. However, as it bounces between $14 - $17 a share, I think the market has it fairly valued given the revenue risks. Starz has a lot of debt (3x) so the stock price has the potential to spike significantly higher above $25 a share if the company can find a way to get subscriber growth of 3% – 5%. Next time we will discuss some potential avenues for Starz to find new subs.

Let me know how you are modeling Starz earnings. What is your price target and your rationale? As always, I love to get reader feedback. But for now, I would recommend waiting for evidence of the turnaround before rushing to buy $STRZ.

-Accrued Interest