Nexstar Media reported Q1 earnings last night. I figured I could use this opportunity to begin coverage. This post will focus primarily on Q1, but I will flesh out my broader thoughts on the television broadcast companies more generally, since this is my first time writing about the sector on this platform.

Company: Nexstar Media (NYSE: NXST)

Recommendation: Underperform. NXST and other broadcasting stocks should be viewed as special-situation trading vehicles – not long-term buy-and-hold investments. To be 100% clear - I would not short any broadcasters as they can easily pop +10% to +20% (or more) on M&A news. Rolling-up TV stations is a very accretive strategy with low execution risk. However, if your timeframe is longer than 12 months, M&A is a pyrrhic victory, because with each deal you are doubling down on an industry with 1) high leverage, 2) in terminal decline with 3) dwindling opportunities for organic growth with a 4) weakening US macroeconomic backdrop. I am bearish on Nexstar specifically, because after the next wave of M&A is over, they will have no one left to sell to. I would turn bullish on NXST if they indicated they were willing to be a seller. If you MUST invest in broadcasters, I would suggest looking among the list of potential Nexstar targets they may gobble up while the animal-spirits of M&A are in the air.

Ownership: I have no positions in NXST stock or options at the time of writing.

Key Q1 Operational Takeaways:

As a former VP of Corporate FP&A, having put together dozens of quarterly earnings packages over the years, I typically skip the management intro and go straight to the financials and the KPI’s. Nexstar did not have any especially large beats or misses in their earnings so let us dive into the nuances of the underlying business.

Distribution was flat, with affiliate rate increases offsetting subscriber declines

On paper, Nexstar’s strategy of pushing for higher affiliate rates from cable companies to offset audience lost from cord cutting appears reasonable. But as I stated in my Fubo piece, “Getting more revenue from fewer customers is a bad business proposition.”

Short-term there is upside to Distribution revenue as 60% of NXST sub base is up for renewal. But an investor’s confidence in the Distribution revenue is related to how worried you are about cord cutting. Based on my monthly tracking of Nielsen TV watch time, I believe YouTube and Netflix will keep taking share and negotiating leverage for Nexstar is only going to weaken with each upcoming contract renewal cycle.

As someone who was a huge broadcasting bull during the 2010’s (Meet 2013 Sohn Conference Winner Simeon McMillan) what is “different this time” is there is no longer a wide monetization gap between cable subs and broadcast subs. A decade ago, it was an easy trade to make money as retransmission fees reset higher and Big 4 subs were underpaid. But with the pay-TV addressable market shrinking, this is a headwind and not an amazing tailwind like back in 2011.

For eagle-eyed readers, Nexstar called out “growth in vMVPD subscribers.” This is their way of saying virtual MVPD services, such as Fubo, pay a higher rate per sub than legacy cable companies. And since Fubo does not have a lucrative broadband business to subsidize the video product, they accept the higher costs.

Advertising revenue was down -4.2%, not -10%, when you exclude political

The growth rates of broadcast TV advertising are affected by political ad spending cycles. NXST tried to assure bulls with two main arguments.

First, management wants you to know that broadcast TV is no longer an advertising play, now that 63% of NXST revenue comes from distribution and other revenue sources. I agree this made broadcast earnings less tied to the business cycle.

What I disagreed with, was management claiming on the CC they were safe from tariff fears, because only 15% of their advertisers are in “goods-based businesses”, such as automotive or furniture. TV is a high fixed cost business, so I think having 15% of your advertisers undergoing economic stress is a big problem.

Remember - broadcast television is losing total advertisers as more businesses jump straight into digital advertising and skip television (and radio) all together. I also disagreed with management comparing today to the 2018 trade war. Any pullback in consumer activity from tariff concerns will lower demand for local advertising.

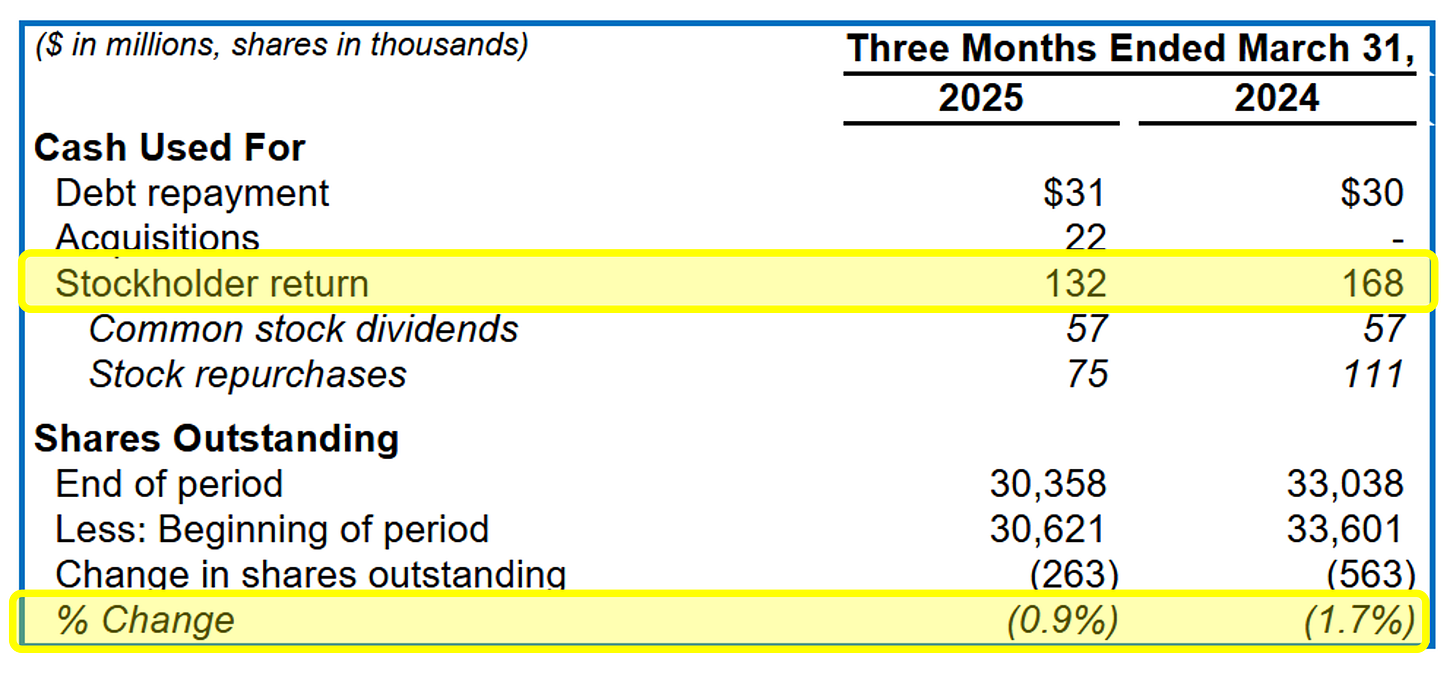

NXST’s capital allocation policy prefers share-buybacks over dividends, debt repayment and M&A

My general feeling about stock buybacks is that they are a value-neutral strategy. Buybacks, like leverage, enhance the existing trajectory of a stock prior to their implementation. Short-term, NXST buybacks will make the stock pop more when they eventually announce M&A. It is my belief that once they have exhausted M&A opportunities, they will come to realize that the cash would have been more effectively utilized reducing debt.

Conference Call Takeaways:

Nexstar management team laid out four main pillars to their strategy. Here is how I feel about each:

Squeezing higher affiliate rates on 60% of their subscriber base in the next cycle of cable company negotiations

Accrued Interest: Smart strategy for next 3 years, but broadcasters’ negotiating leverage is falling each month as YouTube and Netflix take more TV watch time.

Continuing the CW's path to breakeven

Accrued Interest: Cutting programing expenses to achieve profitability at the CW is welcome, but this subscale broadcast network has a tiny audience ceiling and won’t ever be large enough to move the needle on the stock.

Deregulation to allow them to buy more stations nationally, as well as in-market

Accrued Interest: I think the winners of this round of broadcast deregulation will be the broadcast stations that use this opportunity to sell. Loosening ownership rules will make it easier for Nexstar, the biggest broadcaster, to bulk up and for private equity to provide exits. However, audiences will keep declining longer than stations can keep finding “production efficiencies”. On the call, NXST actually compared news crews sharing equipment to local newspapers sharing printing presses.

Personally, I would NOT compare my industry to newspapers if I were trying to inspire investor confidence. This might have been a Freudian slip worth noting for investors…

Conclusion + Next Catalysts to Watch

While Sinclair, Tegna and others are still reporting earnings - I will be covering Nexstar most closely as it is the largest publicly traded broadcasting company. We will talk potential price targets in future updates, but expect NXST and the sector to trade like levered bets on whether the U.S. heads into recession. Smaller broadcaster stocks may be good trades, but only if you want to bet on who becomes an M&A target in the next 12-24 months.

-Accrued Interest

Disclaimer: The information presented in this Substack is not and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

Really good information here. Appreciate the research and diligence you provide on the earnings call, I hadn’t heard that slip mentioning newspapers. We all can see broadcast is declining but to compare yourself to newspapers is scary. Might want to be looking to replace this holding by years end. Cheers!

Excellent article. I also enjoyed your Business Breakdown podcast (how I found and now subscribe). Curious who do you see as NXST most prime m&a targets?