FuboTV – Assuming Coverage

Accrued Interest Stock Pitches

Since it's Q1 earnings season, I'm going to be doing some posts where I give more tactical advice on the companies I talk about. I’ll still write essays about market sentiment, along with my videos, but I want to get back to doing old-school stock writeups, or pitches as most call them. Please leave a comment and tell me what you think! I am just one man, trying to learn about markets…open to other opinions.

Company: FuboTV (NYSE: FUBO)

Recommendation: Underperform (5/6/25) E.g. I expect this stock to underperform the S&P 500 over the next 18 months.

Today I’m doing a formal write-up of FuboTV. I’m using the Substack format to go deeper on some points mentioned in yesterday’s Q1 recap video.

Ownership: I have no positions in Fubo stock or options at the time of writing.

In Fubo’s press release announcing Q1 results - management led with the positives. They focused on achieving revenue targets for Q1 2025.

However, I want to focus on another set of facts. Fubo’s subscriber base, both North American and international, is shrinking. In general, the business is underperforming. I do not believe the stock is undervalued or this sell-off is an overreaction. Investors were entirely correct to send the stock down almost -20% over the last five days.

It's becoming increasingly clear that streaming alternatives to conventional cable TV are facing the same marketability problems old-school TV was facing.

Key Performance Indicators That Tell the Story:

At Accrued Interest I want to focus on understanding the underlying fundamentals driving a business. (I don’t read charts) Here were the key drivers that stood out to me in the Q1 earnings:

North American subscribers fell -3% YoY

Television is a fixed cost business. They cannot cut costs that much when they lose a subscriber. Making matters even worse, North American subscribers were previously growing for the last four quarters.

The growth that they did get from revenue, came entirely from pricing. This is low quality growth. Getting more revenue from fewer customers is a bad business proposition.

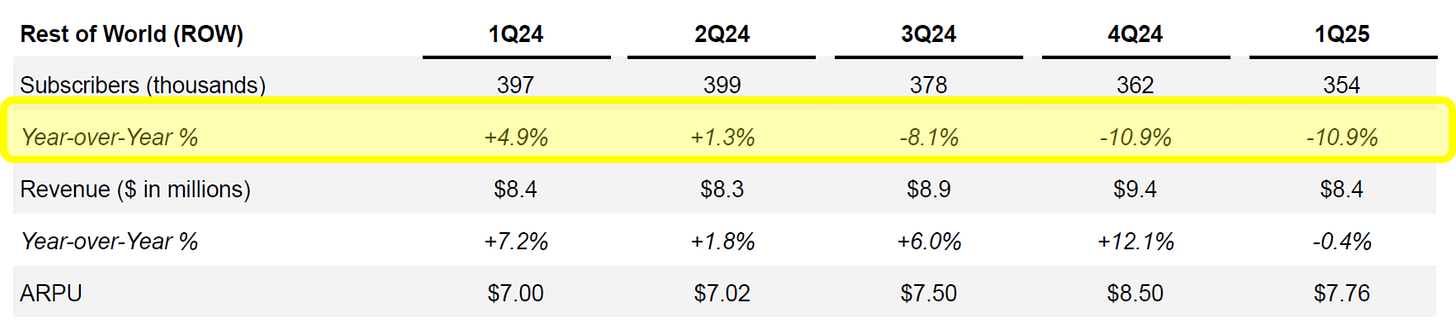

International subscribers were down -11% YoY

International subs are declining even faster than the North American business

I want to clear one misconception. Fubo only has service in Canada and parts of Spain. This stock is not international play. You should go to Netflix or YouTube (Google) if you want that exposure as an investor.

2Q revenue guidance was -14% YoY

If you take the midpoint for North American subscribers, management is forecasting a 14% decline year over year.

The business had many weak excuses for their shortfalls.

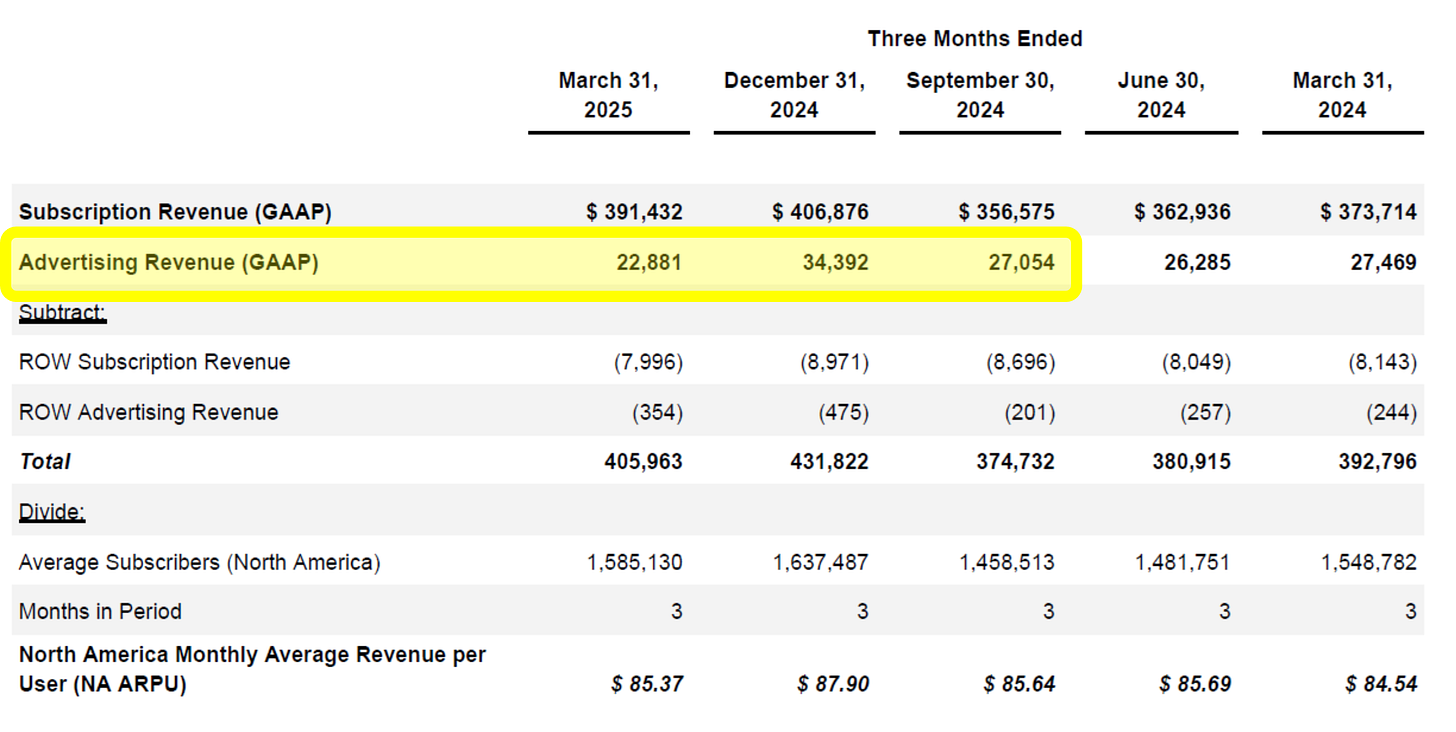

Advertising revenue was down -17% YoY

They lost subscribers from Televisa Univision when they dropped their channels. And losing those channels lost some ad inventory. However, there was no good excuse for such a decline on an already too-small advertising base.

The company knew the Univision channel drops were coming for a long time, and should have been able to find growth in other parts of their business.

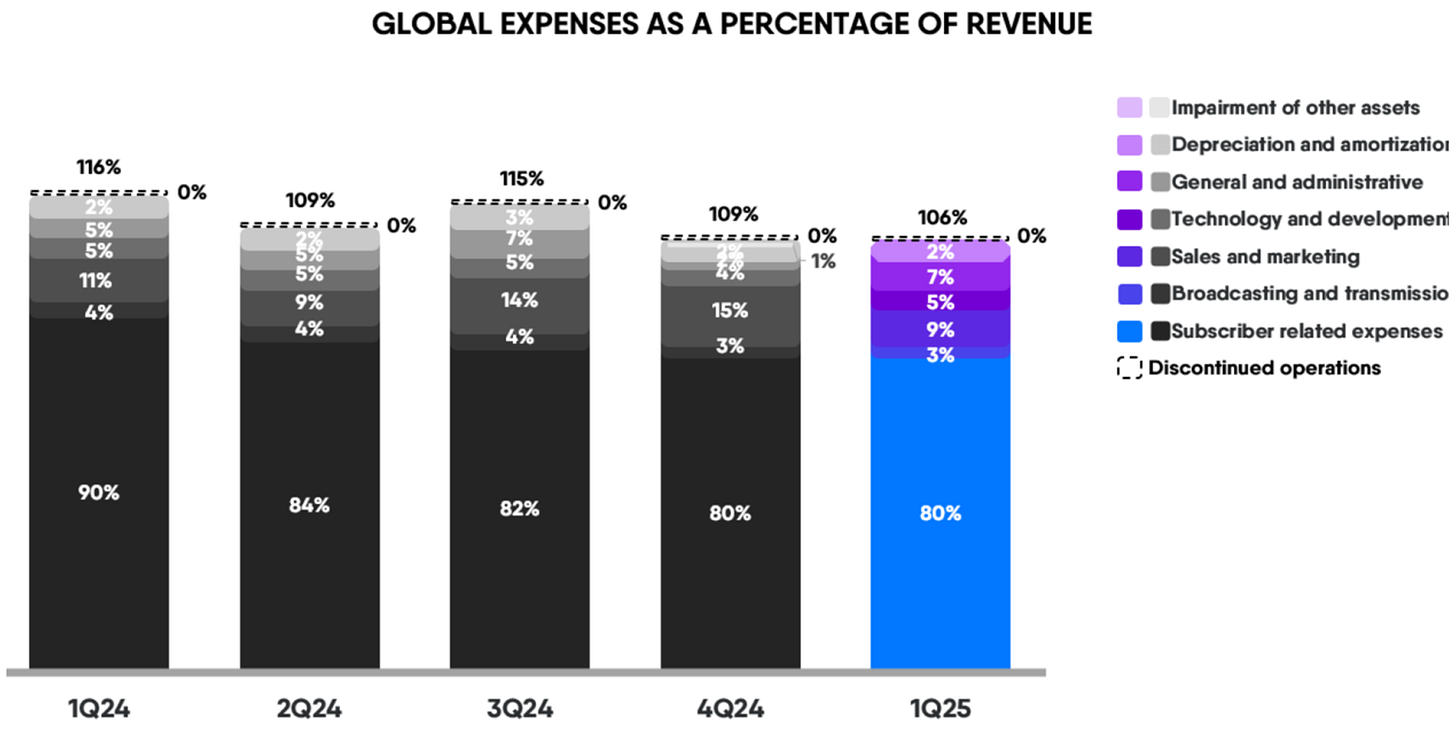

I think it is very premature to get excited about cost cutting / savings at Fubo. Bulls like to hold on to the fact they're going to get some content savings after they do the deal with Disney. I'm here to tell you that cost savings do not matter when revenue is shrinking.

There is a simple reason why Fubo stock is down precipitously since announcing the merger in January. More and more investors are realizing that combining with (part of) Hulu does nothing to change a fundamental truth about the company…

Despite being around for a decade, not enough people want to use the product.

I encourage you to go back to my YouTube page, many of the issues that the company had in Q1, I raised in past videos.

Links to past FuboTV videos:

The Future of FuboTV Part 1: Assessing the Disney-Hulu Merger Impact

Fubo TV's Struggles: Q1 2025 Earnings Breakdown - Accrued Interest Podcast

To be fair to bulls, I previously tried to analyze the upside case. I argued that using management's optimistic forecast, the best outcome you could expect was anywhere between $3 to $5 a share.

If you assume that 10.5x times EV to EBITDA multiple, the full market multiple that Disney got at the time, at most Fubo would be worth about $3.27.

In hindsight - was very odd (and prescient) that both the CEO and the CFO were in the open market selling between $4 and $5 a share.

Upcoming Catalysts

Wednesday, May 7th – Disney releases their Q1 earnings. Hulu Live TV is currently stuck at about 4.6 million subscribers. Also, while management has been forecasting it, they think they can get to 10% revenue growth, Hulu's live sub only grew 5% total in the last two years. Maybe on the call Mickey Mouse can help us figure out where the promised 10% growth is supposed to come from.

-Accrued Interest

Disclaimer: The information presented in this Substack is not and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.