Unlocking Market Insights Part 2: Tracking KPIs

Adding Profit Metrics to our Media Valuation Tracker

This is my second article explaining how I use my Accrued Interest Multiple Tracker. As I said in part 1, I want to market my work and give subscribers a preview of some more advanced research that will eventually go behind a paywall. (Subscribe to me today, as I will have discounts for early supporters!) Today I want to show you how I layer in financial metrics (KPIs) such as revenue growth, EBITDA margins and free cash flow conversion to judge stocks.

Adjusting Leverage Formula for Broadcast Cycle

I made a special adjustment to how we calculate net leverage, but only for the broadcast television companies. Normally I try to avoid adjusting the tracker because the point is to spot anomalies, but this one is warranted.

For only the broadcast stocks, I am averaging the EBITDA for the next 2 years, not just 2025. Net Debt is calculated by dividing it by the average estimated EBITDA for 2025 and 2026.

The reason is because broadcast TV companies have uneven earnings where they get revenue bumps in even-numbered years that align with either U.S. Congressional midterms or Presidential elections. I would caution you to not put too much faith in the political ad projections. Political dollars are the hardest to forecast because they usually are not realized until about 8 weeks before the election.

This doesn’t change the fundamental fact that broadcast stocks have high debt loads with an uncertain future. See the new leverage ratios highlighted in yellow.

Note that the recently annoucnced deal yesterday were Gray TV ($GTN) will be swapping stations with E.W. Scripps ($SSP) was deemed an “even exchange of comparable assets”. As a result, no cash was paid and leverage did not change.

Comparing Revenue Growth and EBITDA Margins

For most trackers, I use KPIs that are either growth rates or profit margins. However, to start, I want to lay out the revenue and EBITDA forecasts for all the companies so I can compare their absolute levels.

Note that Netflix ($NFLX) is the largest company by far in terms of enterprise value, but it still trails Disney in terms of EBITDA and revenue. When we get to the margins in a moment, you will see that Netflix is simply more profitable and has higher margins than many of its media peers. Its premium valuation is warranted.

All the broadcast stocks, except for Nexstar ($NXST) generate less than $1 billion in EBITDA in a typical year (exceptions for political bumps). Broadcast bulls are debating the impact of changing FCC regulations on margins. However, unless the industry finds new avenues for organic growth, they will have a limited revenue base in which to try to grow profits. That’s a tall task.

REVENUE growth is the most difficult KPI to measure. Since media companies tend to have high fixed costs, EBITDA and Free Cash Flow will rise (or fall) faster than revenue in both directions. Growth and margins are interrelated factors to consider. If a company’s revenue grows FASTER than analysts expect, you can expect margins to EXPAND more than forecast.

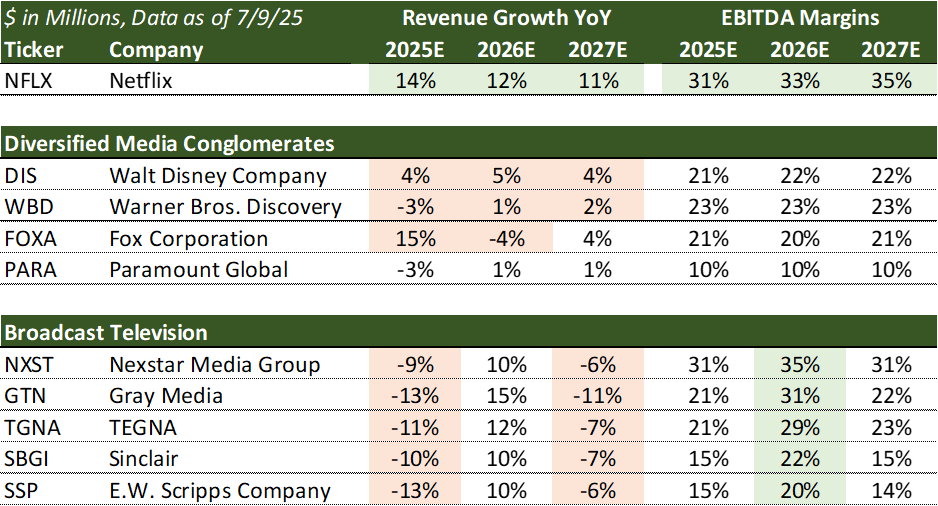

Here is how the group looks when focusing on these 2 KPIs.

The following are key observations:

Netflix ($NFLX) again stands out with both the highest revenue growth, as well as the highest EBITDA margins. After years of having one of the weakest financial profiles in the media industry, today it has arguably the strongest. Please remember this whenever you see it trade at a high EV/FCF of P/E multiple. People are expecting it to grow revenue double-digits annually, and the stock will perform as long as this continues.

Disney ($DIS) is the model for CONSISTENCY. Analysts expect it to grow mid-single digits and maintain EBITDA margins in the low 20’s for the next few years. Investors tend to reward companies with less volatile earnings, higher earnings multiples.

Warner Bros Discovery ($WBD) is in the middle of a spinoff, and analysts are not sure how to forecast the business. The revenue growth expectations of -3%, +1%, +2% for 2025 – 2028 are flat. Sometimes predicting “FLAT” is the right thing to do when you are unsure, but we have to wait until the separation to get more granular estimates for each half of the business.

FOX ($FOX) has some variability in its revenue due to the fact it has a higher mix of broadcast revenue along with its cable assets. FOX revenue fluctuates not just around Political ad cycles, but also for years when they host the Super Bowl. The EBITDA margins for FOX, WBD and DIS are all similar – low 20%’s, but different for Free Cash Flow.

Broadcast Stocks – Here you can see they all have declines in the odd, non-political election years, 2025 and 2027. Relatedly, their EBITDA margins are higher in the even years, see 2026 . The reliance on Political ad spend to make up for lost EBITDA, adds volatility to the business model. Note that Nexstar (NXST) has the most consistent EBITDA margins because almost half its revenue is high margin retans (affiliate) fee revenue from monthly cable subscribers.

Comparing FCF Converstion and Margins

In this last KPI chart I layout two metrics that help me understand cash flow. As I’ve said before on the substack, I have a strong preference for companies that convert more than >50% of their EBITDA to FCF. Let’s go through our stock list one last time and see what these ratios tell us.

Part of why NFLX trades at the highest multiple of EV/FCF, is because it converts a higher portion of every dollar of revenue into FCF. In this tracker, NFLX on average turns over 20% of revenue into FCF. Should revenue beat expectations, then FCF will grow even faster. But keep in mind that expectations are already high.

Disney has 9% FCF margins, lower than most other media peers because the market is “allowing” them to increase capital expenditures to build out their theme parks and cruises. The FCF margins should go higher once the expenditure is over. Mr. Market is patient now, but the stock could see a downside if this high CapEx does not pay off in 2027.

PARA – Note that Paramount has some of the lowest cash flow metrics on the page. They are expected to convert less than 30% of EBITDA into FCF, with an overall FCF margin of low single-digits. This means if PARA misses revenue growth, even by a little, their profits, and stock will fall hard. Buyer beware!

I want to call out FOX yet again, for having some of the healthiest FCF conversion and margins in the media industry. Fox is able to generate more free cash flow because they did not waste billions trying to support a streaming competitor to Netflix, like WBD, DIS and PARA.

The broadcast stocks GTN, SBGI, and SSP have some of the lowest FCF margins. If cord-cutting accelerates and political advertising surprises to the negative, profits could fall quickly at all of these companies.

CONCLUSION — Why Fox ($FOXA) is Interesting

As I said on Monday, the purpose of these trackers is not to argue with Mr. Market, but to understand what investors are expecting, so we can make informed speculation on which stocks we want to own. After comparing the revenue growth, EBITDA margins, and free cash flow conversions, I wanted to highlight Warner Bros Discovery and Fox. See my highlights in blue below.

If I were looking to generate new trade ideas, I would start by doing more research into FOX. Looking at valuation, FOX is trading a slightly lower EV/FCF multiple than WBD. However, from the exercise above, we see that Fox has higher 1) revenue growth, 2) EBITDA margins, EBITDA to FCF conversion and higher FCF margins. Consensus estimates are often wrong - so I am not saying go out and buy FOX today. However, I wanted to show you all how I use my trackers in the investment process and how they can spark insights that AI cannot tell you.

Going forward I will add more companies and KPIs to this tracker. Please subscribe to Substack so you can be on my mailing list when I send them out.

Let me know your thoughts! What financial metrics do you monitor when screening?

-Accrued Interest