Uber's 2025 Performance: Why $UBER Stock Soared and What's Next

Debunking Robotaxi Fears and Highlighting Uber's Strong Free Cash Flow Conversion

OVERVIEW

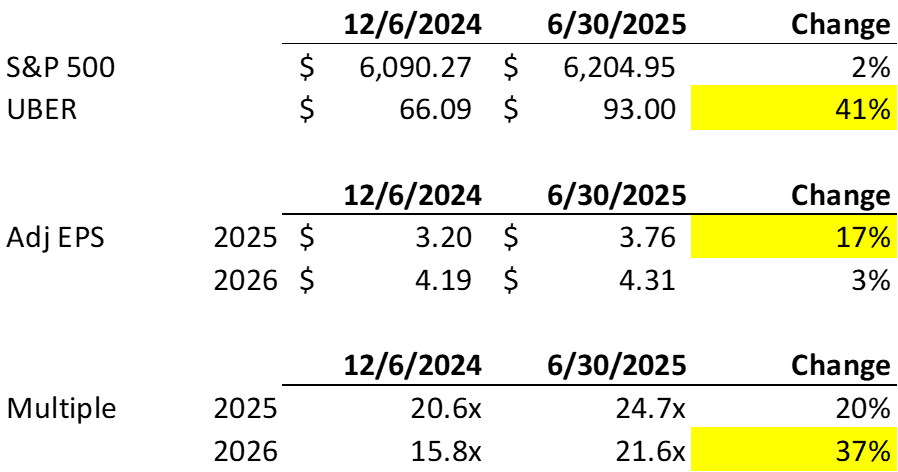

Given the near non-stop pace of “newsworthy” events in 2025, it’s easy to miss that Uber ($UBER) has quietly been one of the best performing stocks this year to date. I teased doing a full write-up on substack, and I wish I had published sooner. Readers can see that I’ve been an Uber bull on Twitter since December 6, 2024. The stock has run from $66 to $93, up +41% outperforming the S&P 500 which up +2%. I still think Uber is a great investment. But now let’s go over 1) why my Uber thesis worked, and 2) where the stock goes from here.

UBER STOCK SUMMARY + STREET ESTIMATES

ACCRUED INTEREST’S UBER INVESTMENT THESIS

Twitter is where I often workshop ideas. Since my thoughts on Uber have not changed over the last 6 months, I’m going to reference my posts, with updates to the thesis.

July 2025 Update: Back in December I thought investors were being too pessimistic.

I recommended the stock before even building a valuation model, because the multiple of 16x 2026 adjusted EPS was too punitive.

These were the following fears I thought were overblown. (You could argue these fears are still present with Uber bears still today)

Fear #1: Waymo was winning share in San Francisco, vs. $UBER and $LYFT.

Fear #2: Tesla could one day take share as well. (MAYBE)

The market sold Uber down to the low $60’s. While I had my doubts, I figured if the market was wrong about Waymo and Tesla, provided earnings remain strong, the stock would recover.

I've observed that when a market leader's competitive edge is questioned, its P/E multiple shrinks even before a decline in earnings occurs.

July 2025 Update: I liked that $UBER was trading close to its 52 week low of $54.84. I prefer to buy after a sell-off or when sentiment is negative.

July 2025 Update: A trick I use is to look at earnings 2 years out. Short-term “noise” can change earnings in 1 year, but year 2 earnings are more normalized.

Back in Dec ‘24, $UBER adjusted EPS estimates were approx. $3.20 for 2025E and $4.19 for 2026E. At the price of $66.09 at the time, Uber traded at 21x 2025 which was not particularly cheap, but at 15.8x 2026, that was below average.

July 2025 Update: I was trying to highlight how Uber had increased the amount of pre-tax earnings (EBITDA) they converted to free cash flow (FCF). As I alluded to in my recent piece on Pinterest ($PINS), I have a strong preference for companies that convert more than >50% of their EBITDA to FCF.

You can see in this table that over the trailing 12 months, Uber improved its cash flow conversion every quarter. Back in Sep-2023, Uber converted 67% to FCF. That steadily rose to 83%, 89% and as high as 101% (!!!) in the most recent quarter at the time (Sep-2024). Double click the chart if you want to zoom in.

Since then, Uber has had 2 more quarterly earnings calls. I will summarize below….

As of Q4, Uber improved to 106% and then again as of Q1-25 to 112%!

When you have a good company, earnings announcements are powerful catalysts.

They serve as public reminders for investors to ignore the negative narratives and focus on all the money Uber is printing for shareholders.

July 2025 Update: I was betting Tesla robotaxis would not affect 2026 earnings. This felt like a safe bet since Elon Musk has been over-promising and under-delivering on self-driving cars for well over a decade.

Tesla launched a limited robotaxi service in Austin, TX, in late June 2025. It included human safety monitors and was more restricted than Elon Musk's promised fully autonomous vehicles.

Waymo has expanded beyond SF, and investors now realize Uber and Waymo can collaborate. Last week, they partnered in Atlanta, allowing users to hail Waymo AVs exclusively via the Uber app. Uber is effectively becoming the preferred network for AV companies seeking rapid scaling.

Lastly, Uber’s Delivery (33% of revenue) and Freight (11%) businesses account for 44% of total revenue, separate from the taxi service.

Now let me show you mathematically how much higher I think it can go:

EXPLAINING UBER’S +40% MOVE - MULTIPLE & EARNINGS

When a stock has a strong run, I like to break down how much of the appreciation came from EARNINGS expectations going higher, vs. MULTIPLE expansion.

From Dec to June, Uber went from $66 to $93, up 41%.

Remember when I said to look at earnings 2 years out to avoid “noise”? In yellow I show Uber’s 2025 earnings are now +17% higher than they were in Dec. But if you had focused on 2026, earnings barely moved, up only 3%. That means analysts had a lot of revisions on 2025, but the 2-year forecast for 2026 barely changed.

As Uber proved with 2 strong quarterly earnings reports that 2026 earnings were not at risk, the market expanded its P/E multiple +37% (see yellow). Uber went from trading at 15.8x 2026 adj EPS to 21.6x today.

I love investing where you can make high returns by just waiting for the market to come to its senses!

CONCLUSION + THINGS TO WATCH

Look - I regret not formally posting about Uber on my Substack before its 40% surge. (But the key lesson here is to follow me on Twitter!)

Over the next 12 months, I could see Uber trading between $107 - $117 per share, +15% to +25% higher than today. My target ranges are based on the same methodology I gave above. A 20x multiple of 2027 adjusted EPS of $5.34 equals $106.80. And 20x the 2027 FCF estimate of $5.80 equals $116.01.

Let me know how you are modeling Uber earnings. What is your price target and your rationale? As always, I love to get reader feedback. For now, I will continue to recommend Uber as an Outperform.

-Accrued Interest

While I don't fully agree, and probably have more concerns about competitive disruption, I love the simple and concise writeup!

Robotaxi did scare me a bit. But so many partnerships, will never be a winner takes all market. People discount scaling, maintenance of robo. Wayve in the UK as well looks promising. I am interested to see how Tesla pans out though