Every Saturday morning I enjoy checking the latest edition of Barron’s for stock inspiration. Today, I came across this bull case on Pinterest - “Pinterest Is a Standout Social-Media Stock—and a Buy”. While I have only used the app sporadically, I never got around to looking too closely at the stock.

I'm kicking off a new series today, tentatively titled "WIP" (Work-In-Progress). This series will focus on stocks I'm actively researching. My deliberate goal is to expand Accrued Interest's coverage universe, and these WIP stocks will help. If you're interested in learning about Pinterest, join me as I document my findings.

STATING MY PRIORS

I admit I'm speaking a bit like a statistician here. When I discuss my priors, I'm merely articulating my current understanding of the business. My views will evolve as I gather more info. I’m going to reference the service Tikr, which I use as my Bloomberg-lite replacement.

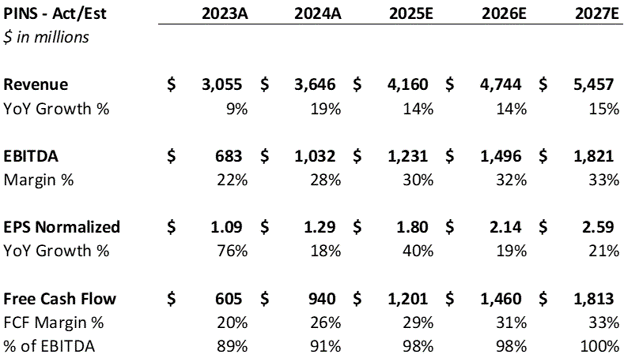

Revenue - Pinterest (PINS) generated $3.7 billion in revenue in CY2024, which is not as big as I would have imagined. My first guess was that Pinterest's existence is partly driven by advertisers looking to diversify their marketing spend beyond Facebook and Google. Pinterest undoubtedly has dedicated users. However, I believe its user base has an inherent ceiling and will always represent a fraction of Instagram's reach.

Analysts forecast mid-double-digit growth, around 15%. I don’t have a strong opinion on revenue right now - we will have to revisit this one.

EBITDA - PINS did $1 billion of EBITDA in 2024, at a 28% margin. I think 28% is very decent, but not particularly high for an asset-light digital business. It looks like analysts expect modest margin expansion - reaching 33% by 2027.

EPS Normalized - With an expected EPS growth of +20% each of the next three years, I can see why some value investors may be drawn to Pinterest. But high EPS growth is easier coming off of a smaller base.

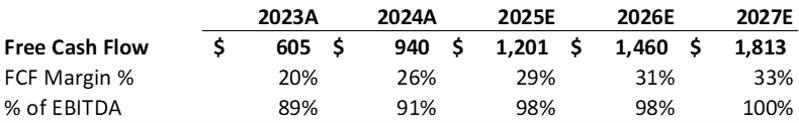

Free Cash Flow – PINS stands out due to its impressive FCF conversion, with analysts projecting $1.2 billion in 2025. The company consistently converts > 90% of its EBITDA to FCF. For me, identifying companies with strong free cash flow growth is a top priority when evaluating new stocks. We'll observe how this plays out!

Valuation – Here’s a high-level table I made to think about Pinterest’s valuation.

P/E - Pinterest's net-cash balance sheet makes P/E a suitable metric. It trades at 16x 2026E and 13x 2027E. This discounted valuation indicates skepticism. I need to do more work to understand the reasons behind this market discount.

Enterprise Value/FCF - I prefer to use enterprise value, and not market cap, when evaluating free cash flow, because capital structure matters. PINS has a LOWER EV/FCF multiple, trading at 14x 2026 FCF and less than 12x 2027. Again, I like this discount as a starting point.

Why Is It Cheap? - The market is not always correct, but you must at least understand the bull / bear argument before you can pick a side…

Here is my WIP take: I think investors believe that Pinterest has a place to exist in the crowded digital ad market, but not a strong product to take share from Meta or Google.

I enjoy learning about companies that are being doubted by the market because they leave room for other investors to change their mind.

If Pinterest hit its estimates and earns the same multiple in 2027, that would mean a stock price of $49 (19x $2.59 EPS) for a potential upside of +44% from Friday’s close.

What I need to explore further – what are the chances Pinterest can at LEAST achieve 15% revenue growth with +30% EBITDA margins?

Let me know in the comments if you have done work on Pinterest and where you think the stock is headed over the next 18 - 24 months. I welcome reader feedback on any and all topics. You can reach me at simeon@accruedint.com. I plan to do some "mail-bag" posts, so emailing your comments is the best way to submit them anonymously.

Enjoy the rest of your Saturday!

-Accrued Interest