Market Musings 4-8-25: The First Step is Admitting You Have a Problem

Acknowledging that “tariffs are bad” is step 1 on the road to recovery

I believe stock markets are having a bit of a mini-relief rally Tuesday, because on Monday a number of public company executives, private sector business leaders and other “Masters of the Universe” took a necessary, but not sufficient, first step towards ending this self-induced crisis.

For the first time in recent memory, business leaders were publicly critical of the 47th President's economic agenda.

Quoted in the Financial Times - Ken Langone, the Home Depot co-founder and major GOP donor, said out loud what many knew to be true, but were too afraid to say.

The current tariff “plan”, if you could call it that, did not make any sense whatsoever.

Utilizing financier's new-found freedom to curse and use words like “retarded”, he went even further, calling it “bullshit”.

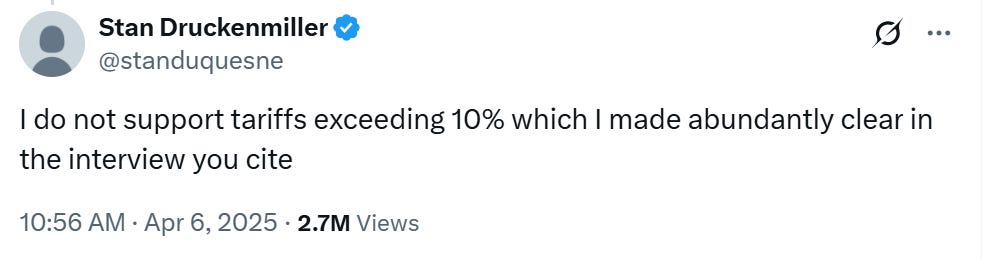

Billionaire investor Stanley Druckenmiller, who has seemingly tweeted only 3 times in 3 years, used his 4th tweet to let it be known he also wasn’t down with the current plan. He said “I do not support tariffs exceeding 10%”.

Even JPMorgan CEO Jamie Dimon, changed his tune. Just 3 months ago while at a conference in Davos, Switzerland he said the tariffs were “good for national security” and that we should “get over it”. Now in his latest annual letter to shareholders he warned tariffs “will probably increase inflation and are causing many to consider a greater probability of a recession”.

Cautious optimism is pushing up the markets on the hope that cooler heads prevail.

But for the sake of argument - let's ignore the talking heads for a second. While the titans of industry can influence the markets, their sphere of influence is limited to just their respective firms. I think those who are cheering the fact that we avoided a repeat of “Black Monday” are missing a key point.

The stock market is made up of thousands of companies, who every day try to make the best decisions they can with limited information, to create as much profit as possible for their shareholders.

Without any firm details on the tariff rates - budget planning, both short-term and long-term, is almost impossible to do. While the doomsday scenario may be off the table (for now), the sum-total of all this uncertainty will be to either freeze or cut back on economic activity.

As we learned during COVID, the global supply chain is a complex web of cross-border commercial relationships. If businesses don’t get firm details soon, they will be forced to cut back on their 2025 and 2026 budgets.

Now we wait for the higher reciprocal tariff rates to start at midnight on April 9th.

I do not think this is the end of the crisis, but rather the end of the beginning.

Accrued Interest