How My Stock Pitch Won the Ira Sohn Investment Idea Contest

Revisiting the 2013 Winning Write-Up

Back in 2013, when I was doing my MBA at Columbia Business School, I won the Ira Sohn Investment Idea Contest with a blind submission where I pitched Tribune Broadcasting. (I was also a semi-finalist, reaching top 12, in 2012 and 2014, but that’s a topic for another day.)

Yesterday marked the 30th annual New York Sohn Investment Conference. Each year at Lincoln Center in May, Sohn brings together the world's top hedge fund managers to share their insights while raising money to support pediatric cancer research.

The conference typically holds a competition where they collect blind submissions from both professional and amateur investors, with the winning stock pitch given the honor of presenting on the big stage. Since there was no idea contest this year, I'm going to use this opportunity to revisit my winning pitch from 12 years ago.

All the following exhibits to follow are from the original pitch deck from May 2013.

This is the roadmap that I gave the audience for the presentation.

First, I wanted to discuss upcoming asset sales that the company had announced of its newspapers, as well as its stake in the Food Network. Next, the broadcast television assets and their cable assets were undervalued. And lastly, I wanted to demonstrate there was a sufficient margin of safety from where the stock was trading at the time.

If I had to give tips on how to win stock pitching competitions, your best bet is to read the classic book by Joel Greenblatt, " You Can Be a Stock Market Genius".

Tribune was a quintessential special situation stock for the following reasons:

Company was coming out of bankruptcy

Limited sell side coverage from the research community, so many were unaware

Not recent with its SEC filings, so one had to work to find the opportunity

Traded over the counter, OTC, also known as the pink sheets, without liquidity

Completed a major corporate restructuring following bankruptcy

Media industry was undergoing changes

Underleveraged balance sheet was an opportunity

New management team

Multiple identifiable catalysts over the next 12-24 months

This was my high-level sum of the parts valuation that gave the audience a preview of where I thought the value was likely to be realized.

I argued that the stock, which was trading at $55 a share, had a valuation range anywhere between $58 and $113.

Next was an overview of Tribune's media assets.

Tribune still owned the Chicago Tribune, Los Angeles Times as well as eight regional newspapers

Portfolio of 23 broadcast television stations, with a mixture of “Big Four” networks (ABC, CBS, NBC and FOX), as well as smaller stations such as the CW

They had a basic cable network, WGN America, and a host of minority investments

Minority Investments

31% stake in Food Network

31% of CareerBuilder

28% of a company called Classified Ventures – which had a number of different listings-related businesses, such as apartments.com and cars.com.

Newspapers

An auction was currently underway at the time of my pitch for Tribune's newspapers. The company announced they had hired investment bankers to run a formal process after receiving unsolicited bids.

Newspapers at the time were profitable for Tribune and had two crown jewel assets whose value was hard to measure - the Los Angeles Times and Chicago Tribune. Ideally, the company wanted to sell to one buyer, but several billionaires had expressed interest.

Upon emerging from bankruptcy, Lazard valued the publishing assets about $623M. That was about 3.2x 2012 estimated EBITDA.

I argued a $1 billion bid was possible given the trophy nature of some of the newspapers. It would still only imply a 5x trailing EBITDA multiple or about $9.90 cents a share. I assumed publishing revenue was still in decline, and then applied a lower than average 10% EBITDA margin to get an estimated 2012 EBITDA of $196M.

Publishing Real Estate

The commercial real estate brokers Cushman and Wakefield had evaluated the company's real estate portfolio. In the bankruptcy documents, they estimated Tribune could earn between $444 million to $504 million with a sale-leaseback transaction to monetize value. That equated to about $4.40 cents a share to about $4.99 cents a share.

I argued that these valuations could prove conservative, because in 2013, we were still coming out the Great Financial Crisis. With the real estate market still recovering, it was possible the value could be higher.

Food Network Stake

Following the sale of the newspapers, Tribune was likely to look to sell its 31% interest in the Food Network back to its majority holder Scripps Networks Interactive.

Food Network was arguably the best property within Scripp's portfolio. It had the second highest affiliate rate per subscriber, highest viewership in the 18 to 34 demo and a portfolio leading EBITDA margin of about 64%. That was higher than the ~51% margin for the rest of the Scripps portfolio.

Here was my valuation for the Food Network stake.

Consensus was that Scripps could pay up to $2 billion, or $20 per Tribune share. In this table, I listed the expected revenue and EBITDA contribution for the Food Network over the three year period from 2010 to 2012.

I comped it with the other cable networks owned by Scripps, such as HGTV, Travel Channel, DIY (do-it-yourself), Cooking Channel and Great American Country. Food Network comped well against these assets, and it made sense that Scripps could consolidate it at 12x EBITDA, which was close to the SNI multiple at the time.

Broadcast Television Assets

Now, let's talk about the media assets starting with the broadcast television stations.

I said on stage at Lincoln Center that the “death of broadcast television had been greatly exaggerated”, and in 2013 that was true. Broadcast television stocks had been on a tear.

They were up on average +163% over the past year. That blew away the S&P 500, which was up about +18%. I argued Tribune stock should ride this wave.

In 2013, cord cutting was still in the mind of investors, but it was different from 2025. Investors were more optimistic on television. It was thought that broadcast would be able to avoid the declining fates of the newspaper and radio industry.

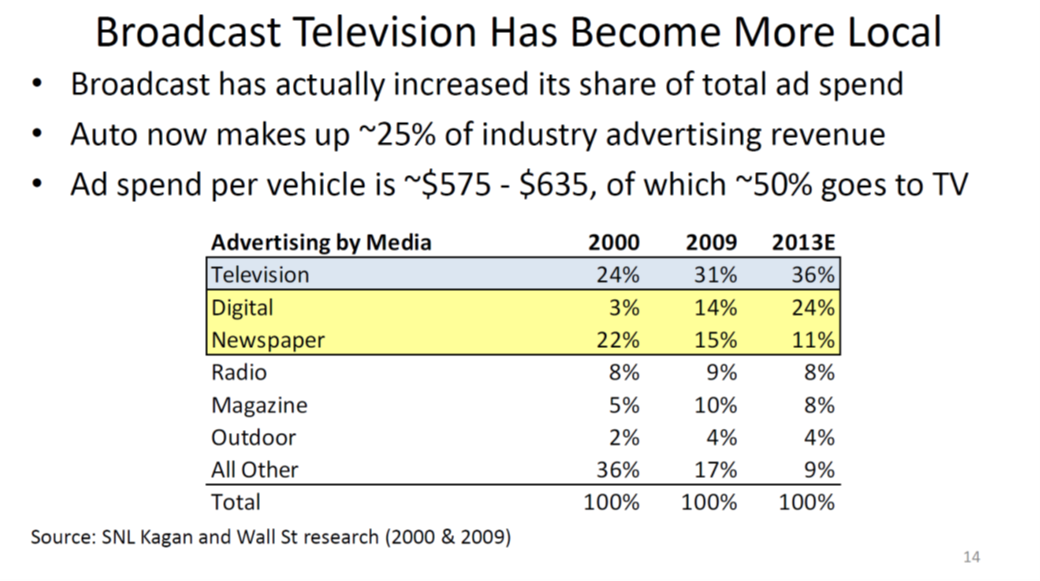

Broadcast television was increasing its share of local advertising. Automotive advertising made up about 25% of industry advertising revenue, and the ad spend per new vehicle sold was between $575 - $635, of which about 50% of that went to television. I went back 13 years and television was actually still growing its ad share.

Tribune and local broadcast television was very much a play on rising ad spend for local automotive sales. The total number of new vehicles sold was still rising, coming out of the recession and the slow-motion recovery.

I argued that in a fragmented world, broadcast TV had value to advertisers because no other medium could aggregate an audience so large at a given time slot as TV.

The evidence I cited was the fact broadcast garnered a premium CPM; that stands for the average cost per thousand impressions to reach their audiences, when advertisers went to buy ads. According to Morgan Stanley research in 2012, broadcast earned an average CPM of $16. That was almost double the $8 CPM for cable and far higher than digital. User generated online videos were getting about $3 CPMs, Yahoo display was around $1, and Facebook was at 20 cents.

Aggressive consolidation was underway in television. TV station multiples had been on the rise as larger public companies were rolling up the industry. SNL Kagan reported that in 2012, 58 television stations sold for a total of over $2 billion, at multiples between 9x to 11x broadcast free cash flow.

That trend carried over into 2013, with Sinclair Broadcasting alone acquiring a combined 42 stations for $842 million. Tribune had stations in some of the largest markets. I laid out some of their top stations and markets to show that they had a strong reach that other companies would want to add. Tribune had stations in 7 of the top 10 broadcast markets, such as New York, Los Angeles, Chicago, Philadelphia, Dallas, Washington D.C., and Houston.

Because they had so many stations in the biggest markets, Tribune reached 36% of the U.S. population, despite having only 23 stations in 17 markets. In comparison, Sinclair had 134 stations in 69 markets, but still only reached 34% of the U.S. audience.

Cable Network Upside - WGN America

Next, I argued there was more upside for Tribune if they were able to increase the earnings potential of their basic cable network, WGN America.

In 2013 full penetration for a basic cable network meant being in 100 million households. WGN America was in about 76 million households compared to over 100M for TNT, TBS, FX and USA Network. WGN America was earning about 19 cents per subscriber from their affiliate deals.

There was room for upside on affiliate rates. TNT, which was more sports-centric, was getting about $1.18 cents. TBS, FX and USA Network, which were more entertainment focused, earned between 48 cents and 62 cents per month per sub, far higher than the 19 cents WGN was earning.

If you thought they could raise their rates, you could see that their free cash flow and free cashflow margins could go a lot higher.

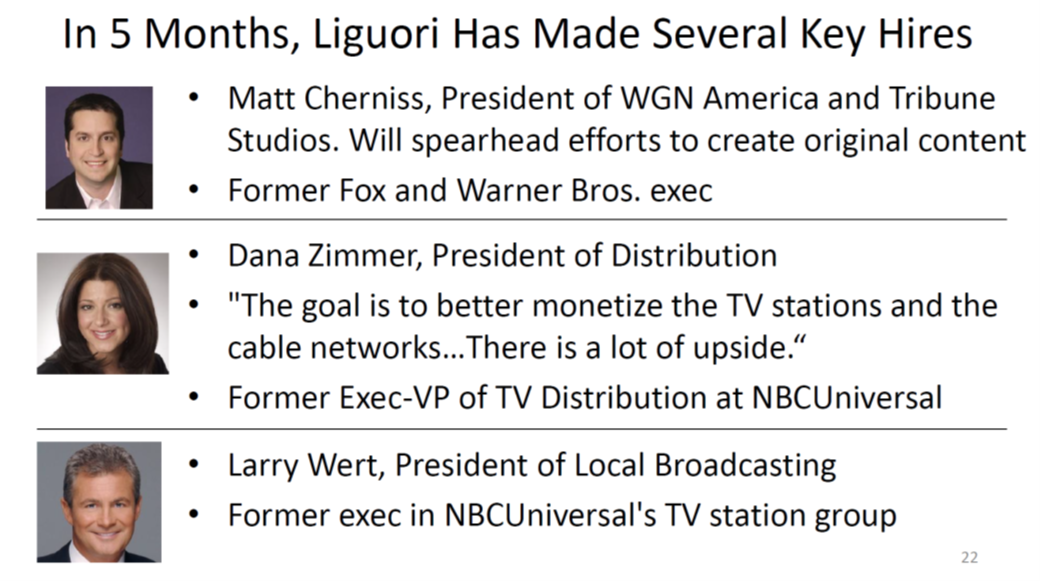

Part of the "Bull" case for Tribune was that they had a new management team led by a CEO named Peter Liguori, who was a proven cable operator. He was credited with turning around the FX cable network into a programming powerhouse.

Liguori was president of FX back in 1998 when it was a small basic cable channel that was mostly airing reruns of everything from M*A*S*H to Buffy the Vampire Slayer. During that time, FX started doing original programming such as Nip Tuck, Rescue Me and The Shield, and that raised the monetization and the profitability of the channel.

I argued that this was possible at WGN America as well.

I explained how Tribune had filled their managerial ranks with executives who had proven track records at companies such as Fox, Warner Brothers, NBCUniversal and others with local market experience.

This is where I laid out the math of how a turnaround at WGN could change the numbers.

In 2016, I estimated WGN could raise their distribution footprint from about 76 million households to between 80 to 90 million. I also argued they could more than double the affiliate revenue per sub, as well as the net advertising revenue per sub. In 2016, the future value of the WGN turnaround could be worth between $23.47 a share to as high as $55.

This stock had a wide margin of safety.

Undervalued Broadcast Assets

Next, I discussed how the broadcast television assets were also undervalued.

The broadcast stations were worth about $22 a share. That's 10x the 2012 trailing EBITDA. Status quo WGN was worth $18. And after the changes, new original programming, getting higher rates, I argued it could be worth $37.

This was my final valuation slide where I argued that Tribune trading at $55 a share, had a base case of $88 a share – for 60% upside.

I wanted to show that a conservative value investor could analyze the different parts, the minority investments, assets for sale, real estate, newspapers, as well as the upside for the remaining TV cable network and broadcast operations.

One could see that this was a very undervalued security.

Catalysts

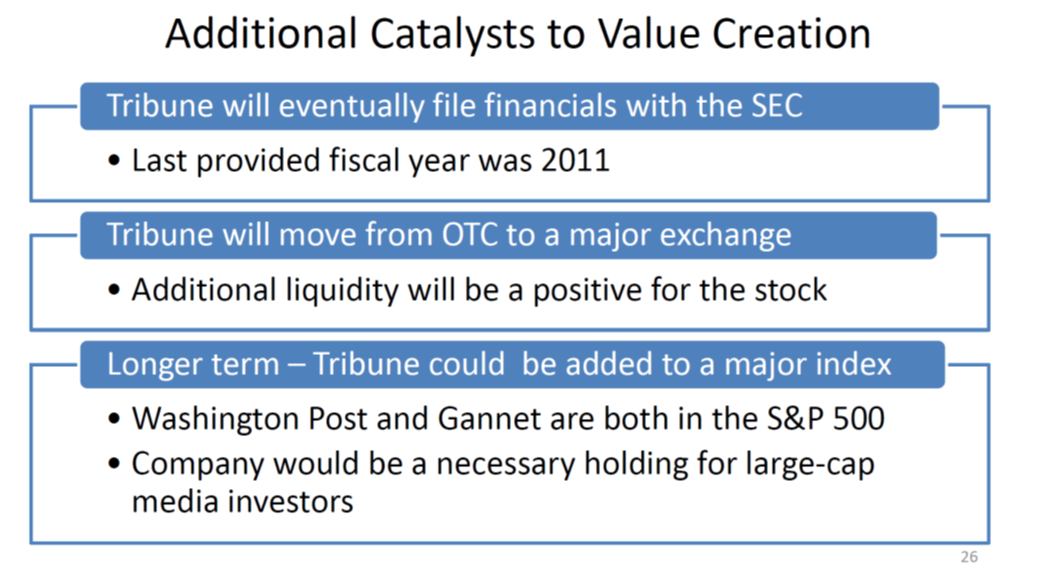

Lastly, I wanted to show there was urgency to the pitch. Here is how I envisioned the catalysts to value being realized.

Tribune was about to file its financials with the SEC. They had last given financial updates in 2011. Investors would finally get a sense of how the company was doing when they moved from trading OTC to a major exchange.

This would add additional liquidity and bring more price discovery to the stock. And long term, since Tribune was a media conglomerate, I thought that it had the potential to be added to the S&P 500, like other media companies at the time.

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

Thanks for sharing. Any updated takeaways now that we're 12 years into the future? Would love to hear what you learned and anything you would do differently (particularly on the process, since we can't know the future).