Fox Corp ($FOXA): Unlocking Hidden Value in Gambling & Streaming

Why $FOX is an Outperform, driven by FanDuel and Tubi

Fox Investment Summary

I am recommending Fox Corporation ($FOX / $FOXA) as an Outperform over the next 18 - 24 months. The company is working to highlight the hidden value of its gambling assets, which include a 19% stake in FanDuel and 2.4% stake in Flutter Entertainment (NYSE: $FLUT), FanDuel’s public corporate parent. The current valuation suggests these are not accurately reflected in the Fox share price.

Trading at $56.25 per share as of market close on 7/18, its 12.7x enterprise value to 2027 free cash flow (FCF) multiple is on the lower end of its media peers, which trade at 14x to 24x 2027 FCF. Mr. Market values Fox based on its association with linear television, linking its prospects to the performance of the traditional cable bundle.

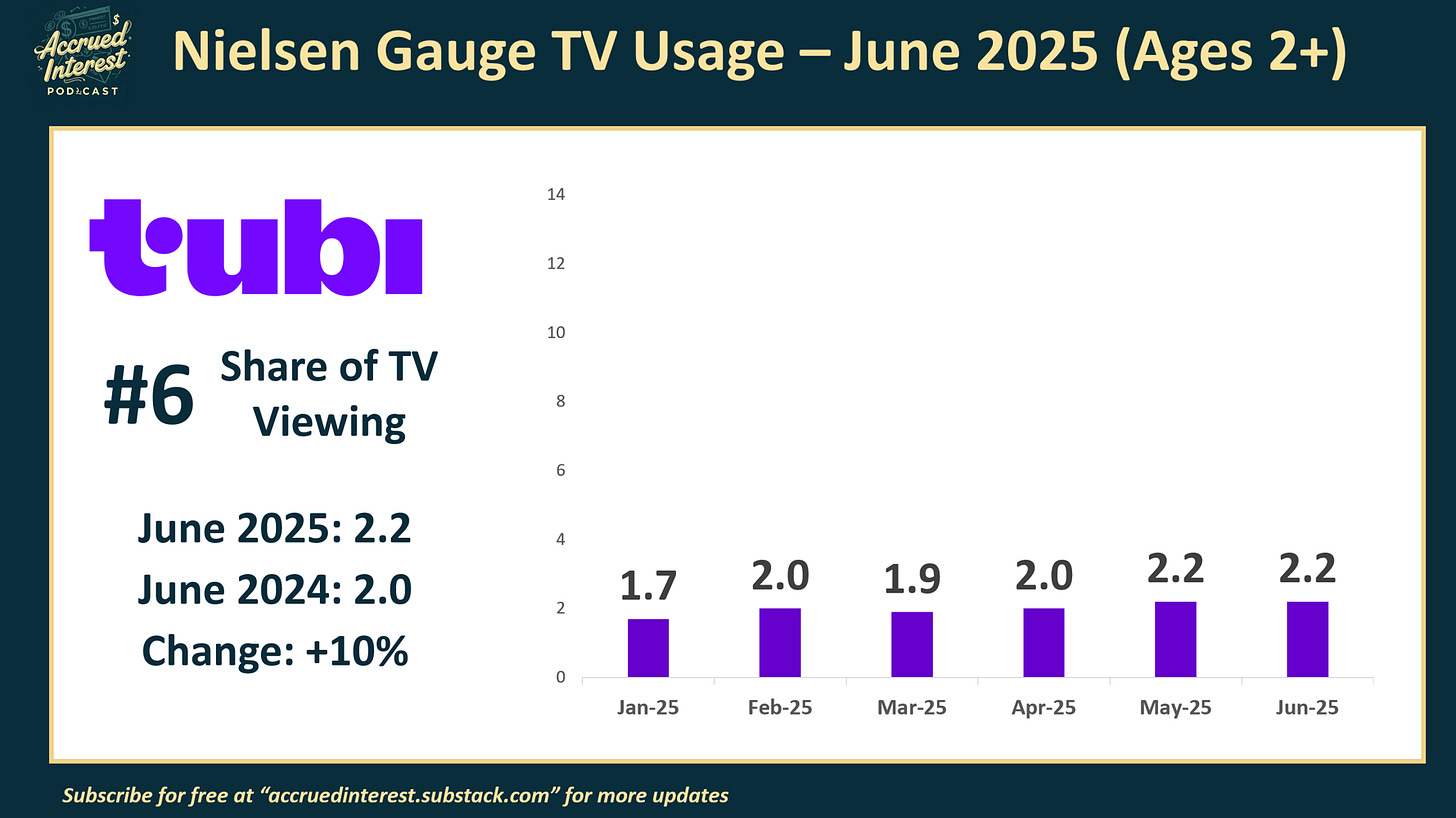

I would argue that Fox is protected from cord cutting due to its dominance of the cable news category and focus on sports and live events. Also, Fox is gaining share in free ad supported streaming television (FAST), with its 100% ownership of Tubi. It may not be a household name yet, but in June 2025, Tubi had a higher share of U.S. TV viewing (2.2%) than Paramount+ (2.0%), Peacock (1.5%) and the combined HBO Max / Discovery+ (1.5%).

If FanDuel and Flutter can each grow their respective valuations by at least 10% per year for the next two years, I forecast the value of Fox’s gambling assets will be approx. $5.5 billion in 2027, or $12.34 per share. Valuing the remaining Fox non-Gambling assets at WBD’s 13.5x multiple of ‘26 / ‘27 average FCF of $2.17 billion equals $29.3 billion in enterprise value. Deducting $3.3 billion in net debt and combining it with the gambling assets gets you $31.5 billion in equity value or $70 per share. I estimate Fox’s fair value to be at least $68 – $72 a share, for a potential upside of 20% - 29% by 2027.

Current Valuation and Consensus Estimates

According to the media stock valuation tracker I update on my Substack, Fox trades at a slight multiple discount to other entertainment companies. Since each company has a different mix of media assets, I compare Fox to a basket that includes Disney ($DIS), Warner Bros. Discovery ($WBD) and Paramount Global ($PARA).

DIS trades at the highest EV/FCF multiple of the group of approx. 30x, because they boosted capital expenditures to invest in their cruises and theme parks. I think Paramount and WBD’s multiples are a closer range for what FOX should expect to receive in the public markets. WBD trades at about 13x - 14x EV/FCF for 2027, which I will use as a reference later for Fox when I produce my price target.

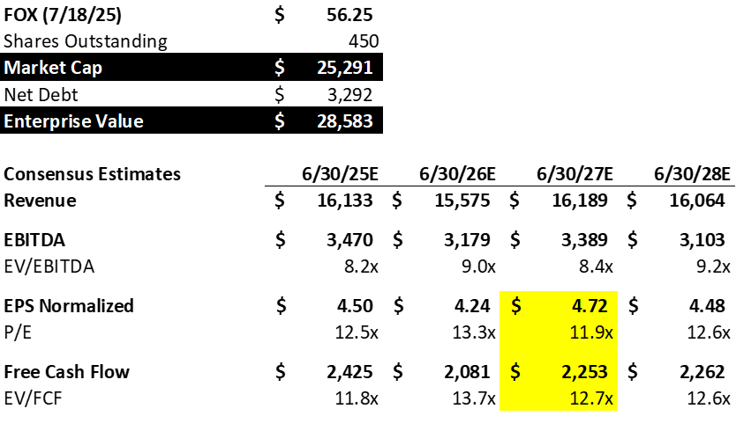

As of July 18th, $FOXA is trading at $56, with an estimated market cap of $25.3 billion, net debt of $3.3 billion for a total enterprise value of $28.6 billion. I used Tikr to compile consensus estimates for the exhibits below. (Please note that Fox’s fiscal year ends in June, not December.) Over the next 2 years, analysts expect Fox to generate revenue of approx. $15.5 - $16 billion, EBITDA of $3.2 - $3.4 billion and free cash flow of $2.1 - $2.3 billion. Please see the table below.

My preferred valuation metric is enterprise value to free cash flow. Currently the market is valuing Fox at 12.7x – 13.7x EV/FCF for ALL its assets; including the gambling assets which we will value later. It is best to think of Fox’s valuation in terms of 2-year averages, because earnings have small spikes during U.S. election years from Midterm and Presidential political advertising. Also, this current year FY2025 had a spike from Fox airing the Super Bowl back in February, which they used to get 1 in 3 years which is now moving to 1 in 4, shared with CBS, NBC, and ABC/ESPN.

Fox’s Core Assets

Since every media company is different, here’s a quick rundown of what assets Fox still owns, after it sold its film and television studios and some cable channels to Disney back in 2017.

1)FOX News Media: This encompasses Fox News Channel (FCN) and FOX Business Network (FBN). Fox News is the undisputed leader in cable news, dominating the category with ~60% share. I consider Fox News to be the most valuable network in the U.S., as it has the audience size and profitability comparable to a Big 4 network (ABC, CBS, etc). It is a must-buy for advertisers.

2)FOX Sports: This includes basic cable sports networks FS1, FS2, the Big Ten Network, and FOX Deportes, along with rights to major live sports events. I think it is bullish that Fox Sports just announced they will be integrating Barstool Sports into their on-air coverage. FS1’s value will increase as sports only become more vital to the pay-tv ecosystem.

3)FOX Entertainment: Segment focuses on original entertainment programming, including scripted dramas, unscripted programming (like The Masked Singer), and its Sunday animation block (The Simpsons, Family Guy, Bob's Burgers)

4)FOX Television Stations: This includes the operation of 29 broadcast television stations, affiliated with the FOX Network and MyNetworkTV. These stations drive significant retransmission revenue. If you want my detailed thoughts on the state of the broadcast television industry, please see my recent interview on the Business Breakdowns Podcast on Nexstar Media ($NXST). While not core to the thesis, I expect Fox to eventually claw back some of the economics from their local station affiliates, despite what the current FCC chair may say. As I mentioned above, Fox News performs like a Big 4 station, so one could argue that Fox is the best positioned broadcast network because it can always use Fox News as negotiating leverage to carry their other channels.

Since investors are familiar with these 4 segments, Fox’s valuation is low because it is viewed primarily as an old-school (albeit successful) television company.

However, I think Fox will outperform the market over the next two years as investors become more aware of the increasing value of their two “hidden” assets which I will describe next.

Hidden Asset #1 - Taking Share in Streaming with Tubi

My first variant perception of Fox is that I do not think Mr. Market is giving the stock full credit for the successful streaming service they own, Tubi.

Tubi: Fox owns 100% of Tubi, a fast growing, popular free advertising supported TV streaming service that currently has about 2.2% share of all U.S. television viewing (June 2025 Nielsen Gauge). Tubi has more U.S. viewership than Paramount+ (2.0%), Peacock (1.5%) and Warner Bros. Discovery (1.4%) which includes HBO Max and Discovery+. Here is a chart of the last 6 months of TV usage for Tubi. It is now consistently above 2.0% following its spike after the Super Bowl back in February.

Tubi is not yet profitable, but I consider it to be a major strategic asset that will ensure Fox remains competitive for streaming advertising dollars as the cable bundle continues to decline.

When asked about a timeline for Tubi to become an EBITDA contributor, CEO Lachlan Murdoch responded, "we have a pretty strict business case for them to get to profitability that we're holding them to, but it won't be long".

Pres/COO John Nallen reinforced this, stating, "This business will achieve margins at 'maturity,' at somewhere in the 20%, 25% range. And it will be a real growth engine for Fox". He also highlighted that FOX has "been moderating our investment into Tubi in '25, and it will moderate yet again in '26".

Management has said they expect Tubi to be a material contributor to Fox's EBITDA in “five years,” reaching the 20% – 25% EBITDA margins typical for mature SVOD services.

Since the earnings in this write-up stop at 2027, I consider Tubi profitability to be a source of future upside that can drive the stock past 2027.

Hidden Asset #2 - Fox’s Sports Betting Assets

My second variant perception is that I do not think Mr. Market is properly valuing their gambling assets in the current stock price. Let me walk you through my assumptions.

For those unaware, FOX holds a 10-year call option to acquire 18.6% of FanDuel, an American gambling company that offers sportsbook, daily fantasy sports, horse racing, and online casino services. Analysts estimate FanDuel (35%) and DraftKings (32%) make up the majority (67%) of the online sports betting and online casino industry. BetMGM (11%) and Caesars Sportsbook (6%) round out the biggest players.

Unlike DraftKings ($DKNG), FanDuel is not yet public, but rather a subsidiary of Flutter Entertainment plc ($FLUT). The option was granted in connection with Flutter's acquisition of The Stars Group (TSG) from Fox. As part of the Flutter-Stars Group merger, Fox Sports (which had a partnership with Stars Group through FOX Bet) gained the right to acquire an 18.6% equity stake in FanDuel.

In addition to the FanDuel option, Fox owns 4.3 million common shares of FLUT, valued at $1.3 billion today.

What gives me the most confidence that Fox will keep their word by monetizing their FanDuel stake, is that Flutter cannot IPO FanDuel without FOX's consent. Since all parties have the same incentives, I expect a FanDuel IPO in the future.

FOX’s Gambling Assets: $8 – $10 Per Share

Let me walk you through my model and how I came to estimate the value of the gambling assets. I try to air on the more conservative side for all my assumptions.

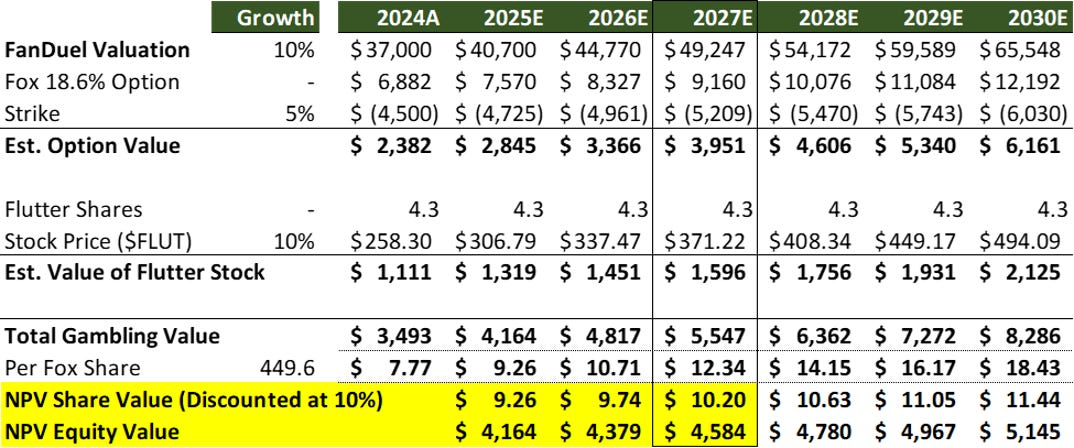

In late 2024, Fox management disclosed that the average sellside analyst estimate for FanDuel’s valuation was approx. $37 billion.

My model assumes that FanDuel’s valuation increases by 10% per year, which I think is conservative given their recent revenue growth trends. I am also assuming the same 10% return for $FLUT stock, although I do not have a strong opinion about the company and am welcome to hear other views.

Working against the company, is a 5% annual escalator for Fox’s option. Said in laymen’s terms - the price at which Fox can purchase their 18.6% stake of FanDuel contractually goes up 5% each year. Please see my math on the table below. All-in, I see the gambling assets making up $8 to $10 per share in value today. That figure increases in the future, but I discounted back using a 10% discount rate to be conservative.

I modeled out the FanDuel option value through 2030, but Fox has made it clear they will 100% exercise it before then. The CEO publicly said they will not sell or divest the option. The exercise of the Fox option has two hurdles - both of which I know will be resolved.

#1 – The option can only be exercised in full, and cash payment is required at the time of exercise. But Fox has low leverage, so they will not have any issue.

#2 – FOX must be licensed as a game operator. FOX has "begun the process with state regulators around licensing". The licensing process is a state-by-state regime, and FOX is "actively in discussions with each of the 26 states that we need to get licensed with". Do not expect this to be a 2026 event, but it is underway.

Conclusion + Upcoming Catalysts

I want to be realistic about Fox’s growth potential. This will not be a stock that will double in the next 12 months. I think $FOXA will outperform over the next 12-18 months as the value of their FanDuel and Flutter equity stakes grow, and more investors are aware of their hidden assets. With a leverage level of only 1x net debt / EBITDA, Fox is underlevered compared to competitors at 2x - 4x. That means Fox will have no trouble raising the approx. $4 – $5 billion needed to exercise their FanDuel option when the time is right.

This table walks through how I get to a $70 price target in the next 12 - 18 months.

My model assumes the 2027 total of the 18.6% FanDuel option and 4.3 million of Flutter common equity will be worth about $12.34 per share in 2027. Said another way, if you deduct the value of the gambling assets from the Fox valuation today, the entertainment assets are trading at 10x – 11.4x enterprise value to free cash flow.

In my mid-point case, valuing the remaining Fox non-Gambling assets at WBD’s 13.5x multiple of ‘26 / ‘27 average FCF of $2.17 billion = $29.3 billion in enterprise value. Deducting $3.3 billion in net debt, and combining it with the gambling assets gets you $31.5 billion in equity value or $70. I estimate Fox’s fair value to be at least $68 – $72 a share, for a potential upside of 20% - 29% by 2027.

Fox will be announcing its quarterly earnings on Aug 5th. Check back here on Accrued Interest and I’ll break down highlights from the quarter. In the meantime, let me know your thoughts. What do you think $FOX shares should be worth and what is your fundamental reasoning?

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

You can always reach me at simeon@accruedint.com.

Thanks, @Simeon McMillan, for this. To be honest, I wasn't aware of the FanDuel option! I never invested in $FOXA as EBITDA has been flatish for the past 5ish years. But now I should take a second look.

Thank you!

Your FanDuel optionalty analysis is really compelling - the 5% annual escalator working against the 10% appreciation is an interesting dynamic. I'm curious how you're thinking about the state-by-state licensing risk though. Getting licensed in all 26 states could take longer than expected and might delay the option exercise past optimal timing. Also, the Tubi comparison to Paramount+ and Peacock is eye-opening, but those services have material sports content driving viewership spikes. Does Tubi's 2.2% share hold up during NFL season when those competitors see bumps?